Economically free countries have fewer and less severe economic crises

#29 | More liberal economies have a lower risk of a severe economic crisis, professor Christian Bjørnskov shows in this report.

Summary

- With most of the world in a deep economic crisis due to coronavirus and the government reactions to it, knowledge of effective crisis policy has become salient. This briefing outlines the association between crisis risk, crisis development, and economic freedom.

- Previous studies suggest that economically free societies experience fewer and not as deep and long-lasting crises as more regulated societies do. An updated analysis shows that these basic findings still hold and that the returns to economic freedom, and freedom from regulation in particular, are substantial during economic crises.

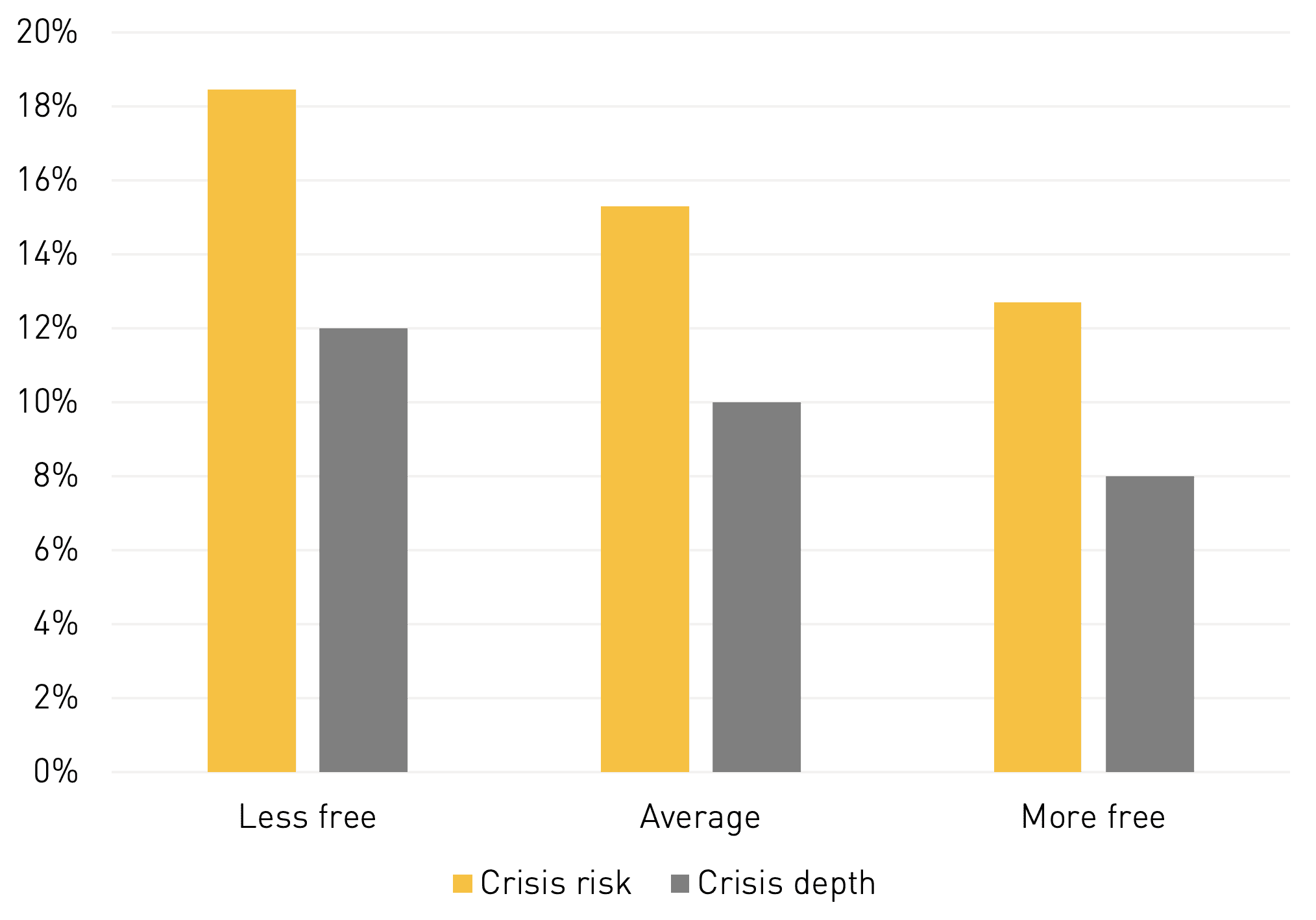

- Higher economic freedom is associated with a lower crisis risk. Across all societies, the crisis risk is 15 percent. Societies with a level of economic freedom ten points below the average have a crisis risk of 18.4 % while societies with a level of economic freedom ten points above the average have an average risk of 12.7 percent.

- Higher economic freedom is associated with a lower loss of income. When a crisis occurs, the average loss of income is 10 percent of GDP. A typical country with a low level of economic freedom (ten points below the median) is likely to experience a 12 percent drop whereas an economically free country experiences an 8 percent drop.

Background

With a pandemic in the spring of 2020, large parts of the world are again plunged into a deep economic crisis. The crisis is partly due to voluntary social distancing, which reduces consumption and other activities, and partly due to the economic lockdowns implemented in most countries. In other words, while most Western governments have increased government spending substantially to prop up firms, they have also introduced substantial regulation that has created a severe supply crisis.

Christian Bjørnskov is Professor of Economics at the Department of Economics at Aarhus University in Denmark. He is also an affiliated researcher at the Research Institute of Industrial Economics (IFN) in Stockholm, Sweden.

As the health crisis is winding down, it becomes important to discuss how to limit the extent of the economic crisis and move quickly out of it. On the one hand, some politicians and theoretical economists have argued for a substantially larger role of government in the economy than before the crisis. On the other hand, other politicians and economists – most prominently the former Canadian prime minister Stephen Harper – have argued that government should play a much smaller role in the economy in order not to stand in the way of new firm creation and economic dynamism. This discussion is, in other words, a matter of more or less economic freedom, i.e. the extent to which policies and institutions protect private property rights and allow people to freely choose what to do with their time, property and other resources. It cannot be solved by theoretical arguments, as the answers to the main question are theoretically ambiguous (Bjørnskov 2016).

Conversely, the small empirical literature that exists shows that economic freedom is consistently negatively associated with crisis risk as well as with their severity. Economic freedom rests on the assumption “that individuals know their needs and desires best and that a self-directed life, guided by one’s own philosophies and priorities rather than those of a government or technocratic elite, is the foundation of a fulfilling existence” (Heritage Foundation 2020, 12). It is regularly defined as a situation where individuals have a de facto right to freely decide how to use their resources and property and that they are economically free when they can “choose for themselves and engage in voluntary transactions as long as they do not harm the person or property of others. […] [E]conomically free individuals will be permitted to decide for themselves rather than having options imposed on them by the political process or the use of violence, theft, or fraud by others” (Gwartney et al. 2019, 1).

Focusing on banking crises, Baier et al. (2012) found that higher levels of economic freedom make general banking crises less likely while an earlier study by Shehzad and de Haan (2009) had shown how increased economic freedom in financial markets is associated with a reduced risk of systemic crisis. Most pertinently, Bjørnskov (2016) compared 212 crisis events between 1993 and 2008 and found that economically less free societies typically have deeper economic crises with slower recoveries. The main conclusions of the original studies have been supported by a number of subsequent studies (cf. Fritzsch 2019, ch. 4; von Laer and Martin 2016).

This briefing paper discusses how economic freedom might affect the risk and development of economic crises. It provides new and updated evidence from 389 crisis events since 1993 documenting that economic freedom negatively affects both crisis risk and crisis depth. The effects of economic freedom are both politically and economically significant.

Why economic freedom matters

While a particular, well-known strand of economists since John Maynard Keynes have argued for political interventions and control of the economy to avoid crises and to guide societies through crises, a string of other economists argue in favor of economic freedom. The Keynesian argument rests on the fact that market failures do exist, and that at least some crises may be due to market failures. However, it also begs the question whether real-world governments are willing and able to design and implement corrective measures or if trying to do so merely creates additional government failures (Holcombe 2012). As originally stressed by Buchanan and Tullock (1962) in their seminal study, even if it is theoretically possible to devise market regulations and fiscal stabilisation policies that prevent crises, protect activity or hasten economic recovery, one must ask two fundamental questions: 1) do politicians have incentives to introduce such policies; and 2) do they have sufficient information to do so effectively? These questions have become central to the public choice school and related developments in robust political economy (cf. Pennington 2012).

The main problem is the combination of rent-seeking and a lack of information, which leads to government failures. This problem is particularly severe in the build-up to economic crises where market information must logically be less precise than in more normal times. The problem is made worse by the influence of special interests that provide biased information to governments and regulators in order to affect regulations to their immediate benefit. Such regulations reduce investments and distort the allocation of resources. Substantial government regulation can therefore lead to deeper crises and a slower recovery, as they prevent the reallocation of resources – financial capital, physical investment and employment – to new and profitable firms and purposes.

Similarly, the influence of special interest groups, as originally outlined by Tullock (1975), can also deepen crises. Although regulation contributes to producing poor or directly counterproductive outcomes, reforms are often difficult due to the “transitional gains trap”: reforms themselves will lead to the disappearance of some of the firms that form a special interest group, which will therefore actively oppose reforms. Over the years, regulated economies therefore risk accumulating a large number of barely profitable, fragile firms that will vanish during a crisis and thus make it much deeper. Economically less free societies also tend to crowd out actual and potential entrepreneurial firms (Bjørnskov and Foss 2016). Entrepreneurs are arguably specifically important during the recovery period of a crisis, as firms and jobs have been destroyed and both new and existing firms have incentives to soak up unemployed resources. Where a lack of economic freedom creates a lack of entrepreneurial activity, crises may therefore become deeper and longer lasting. Labor unions can in principle contribute to the same problem when protecting existing jobs in the short run. They can also prolong economic crises and make substantial unemployment permanent if they do not take long-term unemployed union members’ interests into account when negotiating wages.

Overall, there are a number of reasons to believe that the regular Keynesian prescriptions for how to avoid crises and how governments need to control and regulate the economy during crises are severely misunderstood. If one is to avoid what Buchanan and Tullock (1962) called a “bifurcated” view of human action – that individuals suddenly become fully informed, perfectly rational and other-regarding when they move from the private to the public sector – one should expect that the risk of irrational behavior and systematic mistakes occurring in the market prior to and during crises is much smaller than the risks associated with government failures. Governments are not limited by competitive market forces and regulations and policies affect the entire society. One should, in other words, expect societies characterised by lower levels of economic freedom to experience more and deeper crises, as documented by the original research in Bjørnskov (2016).

Empirical approach

An earlier paper (Bjørnskov 2016) uses data on crises covering the period 1993–2008. This paper expands the analysis by adding data up until 2017. The use of the most recent edition of the Penn World Tables (mark 9.1, Feenstra et al. 2019) allows us to include all crisis events related to the financial crisis known as the Great Recession in 2008–10. We define an economic crisis as an event where annual growth drops below –.2 percent, which therefore does not include mere financial unrest or very brief economic dips. With these data, we follow the approach of the original paper in focusing on four aspects of any economic crisis: 1) the risk of entering a crisis; 2) the period (number of years) in which real GDP per capita decreases; 3) the depth of the crisis, measured as the peak-to-trough ratio of GDP per capita; and 4) the recovery time, captured as the number of years since crisis start it takes to reach pre-crisis GDP. The four crisis characteristics are compared to the index of economic freedom developed by the Heritage Foundation (2020). In additional analysis, the comparison is with the particular index of regulatory freedom that forms part of the overall Heritage Foundation index. Both indices are scaled from 0–100 and available annually with the first observations capturing the situation in 1993. While the extremes in recent years have been Venezuela and Hong Kong at scores of about 25 and 90, respectively, the median is South Africa’s score of 62. Other notable examples are Argentina at 52, and the Nordic neighbors Denmark and Sweden at a score of 76.

With additional information on real (purchasing power adjusted) GDP per capita, population size, trade volumes, regime change,[1] and the number of prior crises in the preceding 20 years, the data form a large panel. The dataset consists of 2,653 country-year observations with 389 separate crisis events of which 343 had ended by 2017. With these data, we estimate crisis risk using a standard logit estimator and the three additional crisis characteristics with a panel data OLS estimator. In all cases, all analyses also account for joint international changes through a full set of annual fixed effects.

Economic freedom affects crisis development

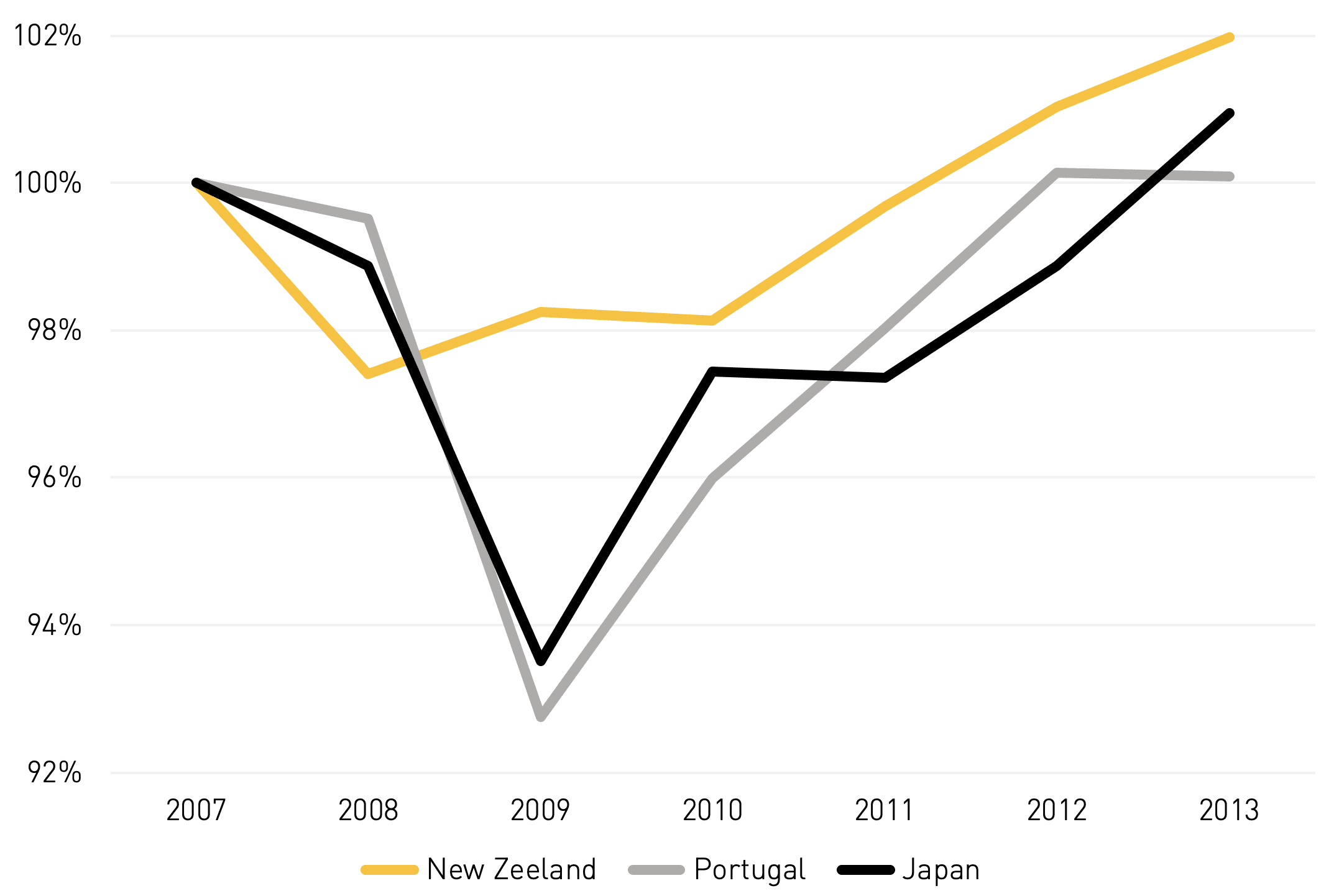

Exploring the raw data, a number of examples offer themselves. Japan, New Zealand and Portugal were all affected by the financial crisis in 2008–2010, and all saw initial declines in incomes from 2007–2008. A priori, one might have suspected that New Zealand – an export-dependent small economy at the periphery of the world – would be harder hit than larger countries such as Japan or the EU member Portugal. However, as evident in Figure 1, the two latter countries fared similarly despite the substantial differences in economic structure while the economically very free New Zealand made it through the financial crisis with a peak-to-trough loss of GDP of only 2.6 percent. Conversely, Japan and Portugal both saw GDP declines of about 7 percent.

Exploring the full data supports the basic implications of these examples: societies below the median level of economic freedom have on average had one additional year of negative growth during the period 1993–2017, compared to those above median economic freedom. Likewise, during crises the former group has experienced an average decline in real incomes of 8.3 % while the income loss in freer countries on average amounted to 5.4 %. It nevertheless also appears that the time to recovery is longer in freer countries (4.9 versus 6.8 years). However, the latter difference turns out to be a consequence of the fact that the Great Recession primarily hit rich countries that also happened to be freer. To sort out such complications, it is therefore necessary to apply the same analytical framework as Bjørnskov (2016).

Doing so yields a set of results that we summarize in Figure 2 below, which illustrates the estimated consequences of differences in economic freedom, all other things being equal.[2] Across all societies, the crisis risk – the probability that a crisis starts in any year – is 15 %. However, the results suggest that societies with a level of economic freedom ten points below the average experience a crisis risk of 18.4 % while that of societies with a level of economic freedom ten points above the average face an average risk of 12.7 %. When a crisis occurs in a country, the new estimates support former conclusions: While the average estimated loss of income across the sample is 10 % of GDP, a typical country with a low level of economic freedom (ten points below the median) is likely to experience a 12 % drop whereas an economically free country experiences an 8 % drop. Conversely, the estimates suggest no differences in terms of recovery time.[3]

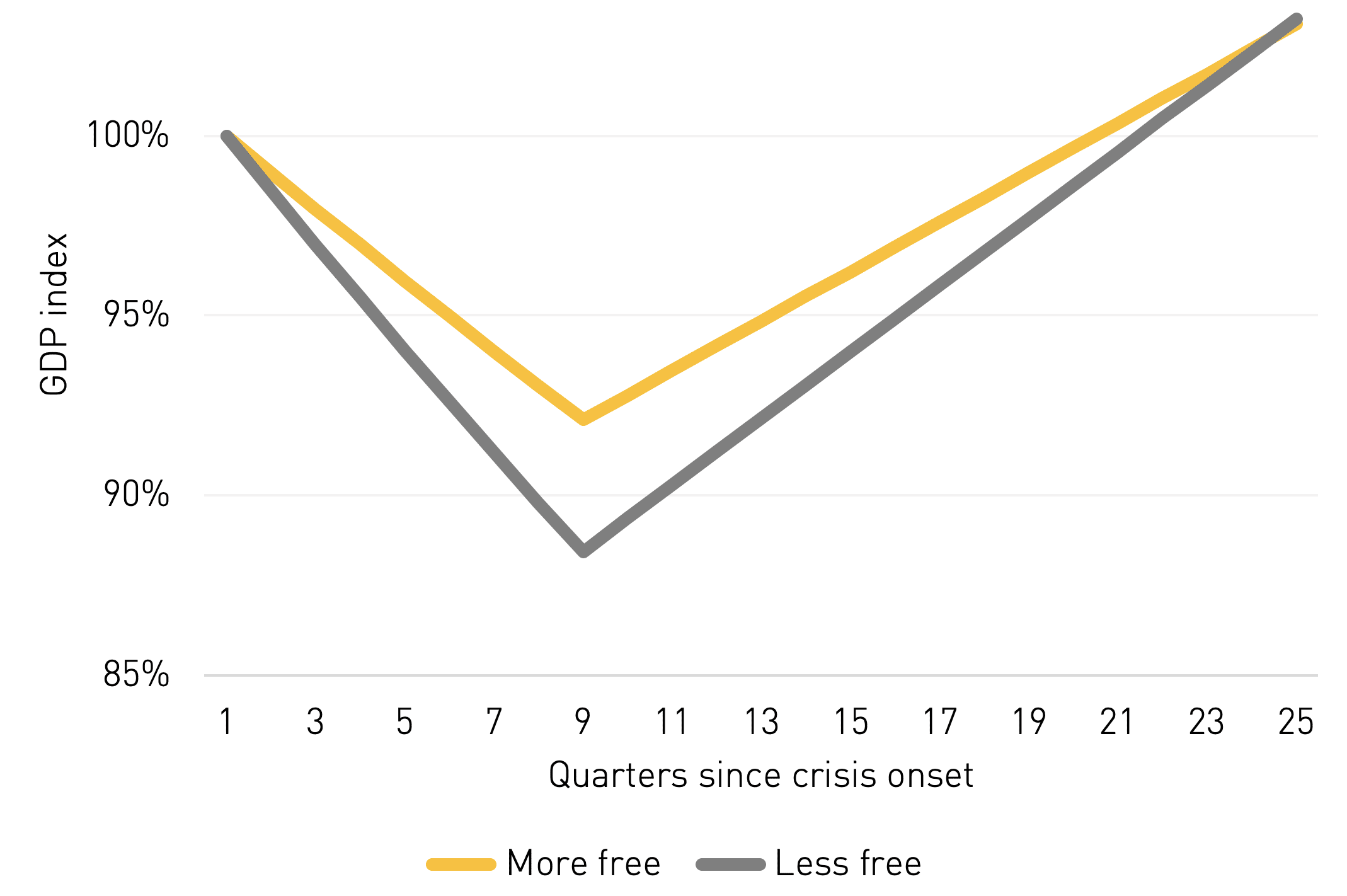

Moving from a level of overall economic freedom ten points below the typical country in the world to a level ten points above makes a substantial difference for crisis risk and development. We illustrate the predicted development of an economic crisis in these two groups in Figure 3, corresponding to the examples of actual development in Figure 1. The median level of economic freedom in the world approximately reflects the policymaking of countries such as Croatia and South Africa while societies such as Argentina, Iran and Ukraine score ten points below that. Conversely, a ten points freer policy environment can for example be found in Austria and Japan, and societies such as Australia, Switzerland and the United Kingdom rate almost ten points higher again.

Conclusions and policy implications

In order to appreciate the economic and political significance of economic freedom, it may be helpful to provide a concrete example with data from specific, representative countries. Austria and Argentina are representative examples of societies with policies and institutions that differ about ten points from the typical country in the world. Austrian economic freedom is similar to that of Norway and only slightly lower than in Denmark and Sweden while Argentina is quite representative for Latin America and large parts of Asia.

Moving from the economic freedom of Austria to that of Argentina, the estimates indicate that crisis risk increases by almost 50 %. Given that a crisis occurs, it also implies that the income loss incurred through the crisis increases by a precisely estimated 50 %. For a typical Western country such as Austria with a GDP per capita at around 50,000 US dollars (480,000 SEK), this means an additional crisis loss per inhabitant of about 2,000 dollars (19,000 SEK). Put in another context, the additional crisis loss in a less economically free society such as Argentina is equivalent to the entire income loss in Singapore during the financial crisis.

Such losses are also typically associated with substantial increases in unemployment and fiscal challenges for the government. The findings therefore also hold significant policy implications for any government interested in avoiding economic crises and unemployment and maintaining fiscal health. As noted by Hall and Lawson (2014), who survey more than 400 studies of economic freedom, economically free countries not only enjoy higher growth but also other social benefits. The clear policy implication thus is that governments should avoid restricting the economic freedom of their citizens. Even if they have the right political incentives, they are unlikely to have sufficient or sufficiently exact knowledge to guide the economy more precisely than a free market, although they often may believe they do so (Knight 1921; Berggren 2012).

The present findings are primarily due to regulatory activity, which both national governments and supranational organizations have engaged heavily in since the financial crisis. The implications of this study, as well as several previous papers, is that governments should be very weary of regulating free markets and need to be humble with respect to what they and the civil service can know. Substantial regulatory activity seems to lead to more crises, and when they do such crises become very costly although large parts of those costs are politically avoidable.

Notes

- Ett tekniskt appendix finns i Bjørnskov (2020), den engelska versionen av denna rapport. Metoden beskrivs också mer utförligt i Bjørnskov (2016). ↑

- The full results are available in an accompanying empirical note. ↑

- More careful analysis suggests that the absence of any difference in recovery times is due to the Great Recession. The original paper focused on crises prior to the 2008-10 recession and found that economic freedom contributes to faster recovery. This is also the case with the updated data when one excludes the Great Recession. The difference is due to the substantially longer recoveries after 2008 that also were more similar across countries than normal recoveries. ↑

References

Baier, Scott Leonard; Clance, Matthew & Dwyer, Gerald P (2012). ”Banking Crises and Economic Freedom”, in James D Gwartney, Robert Lawson & Joshua Hall (eds), Economic Freedom of the World: 2012 Annual Report. The Fraser Institute.

Berggren, Niclas (2012). ”Time for Behavioral Political Economy? An Analysis of Articles in Behavioral Economics”, Review of Austrian Economics, 25:3.

Bjørnskov, Christian (2016). ”Economic Freedom and Economic Crises”, European Journal of Political Economy, 45.

Bjørnskov, Christian & Nicolai J Foss (2016). ”Institutions, Entrepreneurship, and Economic Growth: What Do We Know? And What Do We Still Need to Know?”, Academy of Management Perspectives, 30:3.

Bjørnskov, Christian & Martin Rode (2020). ”Regime Types and Regime Change: A New Dataset on Democracy, Coups, and Political Institutions”, Review of International Organizations, 15:2.

Bjørnskov, Christian (2020). Economically Free Countries have Fewer and Easier Economic Crises. Timbro.

Brambor, Thomas; Clark, William R Clark & Golder, Matt (2006). ”Understanding Interaction Models: Improving Empirical Analyses”, Political Analysis, 14:1.

Bordo, Michael D & Haubrich, Joseph G (2010). ”Credit Crises, Money and Contractions: An Historical View”, Journal of Monetary Economics, 57:1.

Buchanan, James M & Tullock, Gordon (1962). The Calculus of Consent: Logical Foundations of Constitutional Democracy. University of Michigan Press.

De Haan, Jakob; Sturm, Jan-Egbert & Zandberg, Eelco (2009). ”The Impact of Financial and Economic Crisis on Economic Freedom”, in James D Gwartney & Robert Lawson (eds), Economic Freedom of the World: 2009 Annual Report. The Fraser Institute.

Feenstra, Robert C; Inklaar, Robert & Timmer, Marcel P (2015). ”The Next Generation of the Penn World Table”, American Economic Review, 105:10.

Fritzsch, Robert (2019). Adaptive Efficiency During the Great Recession: An Analysis of the Institutional and Organizational Determinants of Crisis Resilience. Springer.

Gwartney, James; Lawson, Robert; Hall, Joshua & Murphy, Ryan (2019). Economic Freedom of the World. 2019 Annual Report. Economic Freedom Network.

Hall, Joshua & Lawson, Robert (2014). ”Economic Freedom of the World: An Accounting of the Literature”, Contemporary Economic Policy, 32:1.

Heritage Foundation (2020). 2020 Index of Economic Freedom: Promoting Economic Opportunity and Prosperity. The Heritage Foundation & Wall Street Journal.

Holcombe, Randall G (2012). ”Make Economics Policy Relevant: Depose the Omniscient Benevolent Dictator”, Independent Review, 17:2.

Knight, Frank (1921). Risk, Uncertainty, and Profit. Houghton Mifflin.

von Laer, Wolf & Martin, Adam (2016). ”Regime Uncertainty and the Great Recession: A Market-Process Approach”, Independent Review, 20:4.

Pennington, Mark (2012). Robust Political Economy: Classical Liberalism and the Future of Public Policy. Edward Elgar.

Tullock, Gordon (1975). ”The Transitional Gains Trap”, Bell Journal of Economics, 6:2.