Displacement Jobs – On the Swedish Employment Subsidies

The Swedish labor market makes use of twelve different forms of employment subsidies involving three percent of the entire active work force. In this paper Dennis Avorin, business analyst active within the EU, shows how the costs of these subsidies have become particularly pressing after the Swedish government in 2016 commissioned the Swedish Employment Agency to create 5,000 public relief jobs before the end of 2020. Research conducted in Sweden shows that while employment subsidies sometimes yield positive effects on an individual level—an obvious result—they also cause displacement of real jobs and individual lock-in effects.

Abstract

Today, the Swedish labor market makes use of twelve different forms of employment subsidies involving three percent of the entire active work force. The costs of these subsidies have become particularly pressing after the Swedish government in 2016 commissioned the Swedish Employment Agency to create 5,000 public relief jobs before the end of 2020. This program was initiated despite the fact that research generally indicates that public relief jobs is the least effective, as well as one of the most expensive active labor market policies (ALMP’s).

Research conducted in Sweden shows that while employment subsidies sometimes yield positive effects on an individual level—an obvious result—they also cause displacement of real jobs and individual lock-in effects. International research further shows that Sweden are among the leading countries in the world utilizing methods categorized as especially inefficient. In other words, the existing strategy is in need of reevaluation. An alternative is to focus on market deregulation and lower business taxes. Public programs, with the exception of those aiming at especially vulnerable groups, e.g. people with disabilities, should be restricted to commercial vocational training programs, since these have the benefit of not displacing regular jobs.

About the author

Dennis Avorin is a business analyst active within the EU with a Master Degree in interdisciplinary research of transition economics and political science from the University of Bologna. He has previously served as Country Desk Officer at the Swedish Ministry for Foreign Affairs.

Introduction

Sweden spends more than any other EU country (percentage of GDP) on various forms of employment subsidies and incentives[1] with twelve different programs actively in use. Their respective purpose has often been linked to each other, hence it is not easy to get an overview. Initially, employment subsidies were introduced to provide job opportunities for people with disabilities. Over time, they have come to include the young, the long-term unemployed, and newly arrived immigrants, and have become popular political tools across the entire political spectrum.[2]

Although some studies have shown positive effects, the downside is evident and shouldn’t be neglected.[3] Employment subsidies have lock-in effects that need to be investigated to assess whether they even attain their purpose. This is especially urgent in view of the government’s instruction to the Swedish Public Employment Service to create 5,000 relief jobs before the end of 2020.[4]

The latest overview of Swedish employment subsidies was provided in 2014 by Almega, a service sector association. Since then, further subsidies have been added to the repertoire. Still, there is no all-inclusive account of the subsidies and their purpose, which not only complicates any analysis, but also makes it difficult for employers even to understand how to apply the system to their special conditions. In addition, several international as well as Swedish studies have reached not only the conclusion that employment subsidies create displacement of regular employment and lock-in effects on the labor market,[5] but also that public sector measures is an expensive route towards employment. Only in 2017 the cost was estimated to 18.4 billion SEK, a five percent increase in three years,[6][7] and while Almega’s study suggested a simplification of the system it has rather been made even more complicated.

The emergence of employment subsidies

Employment subsidies and recruitment incentives have been an integrated part of Swedish labor market policies for almost a century. The origin of employment subsidies can be traced back to the economic debates of the 1930’s, when economist Nicholas Kaldor suggested employment subsidies for people with disabilities.[8] During the 1960’s, Sweden introduced various forms of sheltered state and municipal employment options. These involved sheltered employment in workshops, industrial relief jobs, etcetera.[9] In 1977, the responsibility for sheltered employment was allocated between the county councils and the state following a public study proposing that the activities should be coordinated regionally as well as nationally. Industrial relief jobs at this time were regarded a quick fix against the dynamic cycles of the labor market. In 1980, a state-owned company, Samhall (initially Stiftelsen Samhällsföretag), was formed to assign and operate relief jobs.[10] In 1992, Samhall was converted into a limited liability company while retaining state ownership.[11]

During the Swedish economic crisis of the 1990´s, a new category of relief jobs were introduced only to be eliminated in 1997; between 1981 and 1997 private companies could receive financial recruitment aid; between 1993 and 1998 the government offered tax-funded job-training (ALU, as well as workplace introduction (API) between 1995 and 1998. Further measures during the 1990’s included trainee replacement programs (utbildingsvikariat, 1991-1997) stand-in jobs (resursarbeten, 1997-1999), and academic and immigrant internships (akademiker- och invandrarpraktik, 1993-1995). All of these were operated by Arbetsmarknadsstyrelsen (AMS) and hence known as ’AMS-actions’ (AMS was the antecedent to the Swedish Public Employment Service, Arbetsförmedlingen). The structure of today’s employment subsidies arrived in 1997 with the entitlement to financial aid in conjunction with hiring of new employees (förordningen om anställningsstöd).[12] The responsibility for applying these measures were in its entirety transferred to the Swedish Public Employment Service (Arbetsförmedlingen) when it was formed in 2008 and assumed responsibility for the operations of AMS. The central directives for employment subsidies are financial aid in conjunction with hiring of new employees (1997:1275); extra aid for people with disabilities (2000:630), the Employment Protection Act (1982:80); regulations for civil service employment (1994:260); labor policy programs (2000:625); and the Agency Work Act (2012:854).

Employment subsidies proper are directed towards three groups: unemployed youth, recently arrived immigrants, and people with disabilities. In addition, the center-to-right coalition of 2006-2014 installed subsidies called new start jobs (nystartsjobb) and entry recruitment incentives (instegsjobb). In the following section we will provide an overview of the current employment subsidies and how they were formed.

New start jobs and entry recruitment incentives

The employment subsidies known as new start jobs (nystartsjobb) and entry recruitment incentive (instegsjobb) were implemented by the center-to-right coalition in 2006 and began to take effect in 2007.[13] In order to be eligible for entry recruitment incentive a person has to be a recently arrived immigrant of at least twenty years, registered at the Public Employment Service, and have been granted residence permit. When an employer hires a person fitting these demands, eighty percent of the salary cost up to 800 SEK/day for a maximum of two years is provided by the government. Further, the employee is granted guaranteed insurance coverage in accordance with the present collective bargaining agreement.

New start jobs are supported by a wage subsidy, and demands that the employee carries a permanent residence permit. The subsidy covers two thirds of the salary in addition to payroll taxes, and the salary is set by the present collective bargaining agreement. These employments are supported for a maximum of three years from when the receiver has become a permanent resident. There are no requirement on insurance coverage or benefits, though the subsidy entitles to unemployment benefits after the completion of the program. This arrangement tends to create an incentive for municipalities to not offering permanent employment to those who have completed their three years of subsidized employment. It follows from the fact that the currently unemployed receive welfare from the municipality. Obviously, then, it benefits the local budget to offer a new set of unemployed the same kind of new start jobs, subsidized by the national government, rather than hiring those who have been on the job for three years. Instead, these will re-enter into unemployment, where they will be supported by the very unemployment benefits that came with their now terminated employments, and thus not become a financial burden on the municipality.[14]

Entry recruitment incentives are similar to new start jobs except for the absence of the requirement to partake in Swedish language training (SFI). Also, the demand on insurance coverage is weaker. Hence, entry recruitment incentives often displace new start jobs as the subsidy of choice.[15] Formally, the subsidy is higher for entry recruitment incentives than for new start jobs. However, the differences in funding cap and insurance requirements amount to only a small difference in the actual salary cost. In 2013, The Swedish National Audit Office (Riksrevisionen) therefore proposed that the state ought to create a more substantial gap between the subsidy rate for entry recruitment incentives compared to new start jobs—the instrument would be a demand on equal requirements for benefits and insurances. An increase in the number of entry recruitment incentives would require the Public Employment Service to coordinate its actions towards employers in order to force stricter resource management.[16] The total annual cost of entry recruitment incentives have increased from less than 200 million SEK to a full 675 million SEK from 2008 to 2015.[17]

In the 2013 study by the Swedish National Audit Office it was noted that no exhaustive evaluation had been made regarding the effects of employment subsidies. However, conflicting objectives could be detected when people were employed through subsidies and consequently missed the Swedish language training necessary for consistent inclusion on the labor market. The Swedish National Audit Office also points out that subsidized employment resembling real jobs typically have positive effects on individuals.[18]

Overall, there seems to be a consensus between the two major political blocs that both entry recruitment incentives and new start jobs are crucial measures. Only the populist Swedish Democrats Party has motioned to repeal employment subsidies chiefly based on the fact that these are partly directed at immigrants. Nonetheless, the debate on the design of employment subsidies has at times been heated. During an interpellation in 2007, Patrik Björck (MP, Social Democrat) thus criticized new start jobs on the grounds that receivers typically returned to unemployment.[19] A year later his party colleague Luciano Astudillo offered the same criticism.[20] Katarina Brännström of the center-to-right Moderate Party has more recently (2015) argued for abandoning collective bargaining agreements for new start jobs within small business.[21] Apart from this, however, few disagreements exist on the issue between the two political blocs.

Five wage subsidies

A second category of employment subsidies with an even longer history are the so called ‘five wage subsidies’ to assist people with disabilities. The five wage subsidies are in a rather confusing state, hence the current government of Social Democrats and the Green Party has proposed a clarifying name-change.[22] Four out of the five wage subsidies are subject to the Employment Protection Act (LAS). Employers are also required either to subscribe to the collective bargaining agreement or to offer salaries and benefits equal to the collective bargaining agreement. One part of the agreement mandates insurance coverage which then also becomes an obligation for employers utilizing the subsidies.

The next subsidy is the ‘wage subsidy for employment’ (lönebidrag för anställning), labeled thus, since July 1st of 2017. In essence, this was created to facilitate employment for people with disabilities or reduced working capacity.[23] According to this, employers receive compensation when adapting the workplace to meet special needs. This compensation has been set by the Public Employment Service and is allowed to match a salary of 16,700 SEK/month. In addition, there also exists an ‘arrangement contribution’ (anordnarbidrag) of up to 70 SEK per day to compensate for special costs.[24] Indications suggest that this form of wage subsidy not seldom is being overused, a state of affairs brought to attention by Kerstin Nilsson (MP, Social Democrat) in an interpellation to Hillevi Engström (Minister of Employment, Moderate Party) in 2013. In this document, Mrs. Nilsson described widespread overuse and displacement of regular jobs.[25]

We now arrive at the subsidy called ‘development employment’ (utvecklingsanställning, recently renamed ‘wage subsidy for development’, lönestöd för utveckling). This is used to aid employees in need of work adaptations and development efforts. It is allowed for a maximum of two years,[26] and is for all practical purposes identical to the above mentioned wage subsidy, with the added goal of developing and increasing the working capacity of employees. It allows employers an arrangement contribution for special costs up to a maximum of 130 SEK/day.[27] An example of how development employment can be used was brought to attention by the well-known project The Cultural Heritage Effort (Kulturarvslyftet), where employees were granted subsidies (2011:1560) to cover expenses for the revitalization of Sweden’s cultural heritage.[28]

A third form of subsidy is the ‘secured employment subsidy’ (trygghetsanställning) which offsets the extra costs involved when an employee’s working capacity for some reason is reduced.[29] Secured employment subsidies are managed by the Public Employment Service and are reevaluated every four years.[30]

The fourth salary subsidy is the ‘sheltered public employment’ (OSA). It was one of the first subsidies put in place and dates back to a 1977 proposition on sheltered employment and occupational rehabilitation.[31] It is offered exclusively to tax-funded work-places operating outside the private market and is designed to help people with social disorders. In addition, it covers public employees who are entitled to special efforts according to the aforementioned law on service and support for the disabled.[32] The protected public employment subsidy focuses exclusively on persons challenged with addiction or substance abuse or cognitive disabilities.[33] Out of the five salary subsidies, the sheltered public employment is the only one that is not regulated by the Employment Protection Act.

The last of the five subsidies is sheltered employment at Samhall. Rather than being a straightforward subsidy, Samhall functions as a governmentally owned and operated employer in its own right, and its unique structure has long been a topic of discussion. In 2009, Samhall was criticized for excluding people with especially serious disabilities and instead hiring people who actually qualified for regular jobs, thus contributing to lock-in effects.[34] In 2004 the Liberal Party thus proposed the elimination of Samhall in favor of an equivalent direct economic support to private businesses and municipalities.[35]

Finally, the public study ‘It should be easy to do right’ (Det ska vara lätt att göra rätt) underscored the obvious fact that regulations of employment subsidies are confusing. An equally obvious observation was that the risks for misguided and unintended subsidies are considerable. It pointed to the limited ability of the Public Employment Service to interpret and explain the conditions under which various subsidies should be applied.[36]

Additional employment subsidies

In addition to employment subsidies for recently arrived immigrants and the five wage subsidies, there exist special employment subsidies to meet yet other goals. These programs have often been designed to create jobs for young adults, but in most cases their scope has widened to include also recently arrived immigrants. The latest invention in terms of active labor market policies (ALMP’s) that applies to both recently arrived immigrants and long-term unemployed are ‘modern relief jobs’ (moderna beredskapsjobb). These public jobs were pragmatically implemented in the wake of the 2015 refugee crisis, and weren’t legislated. They resemble ordinary jobs except that they have been created by the Swedish Public Employment Service after an executive order by the government. The goal is to employ at least five-hundred persons during 2017, and to reach 5,000 before the end of 2020.[37]

To receive government support for a public relief job an employer has to be a public entity that have not laid off any employee during the last twelve months. In addition to coverage of salaries, the public entity can also be eligible for a refund of 150 SEK/day for providing professional guidance during the first three months of employment, and after that 115 SEK/day.[38] A memorandum released by the Prime Minister’s Office in preparation for the public relief jobs program stated: ”Sweden needs more simple jobs, but not reduced wages. The state now moves ahead and creates modern relief jobs through its various administrations. These will be modest jobs under good working conditions that will lead to work experience while offering a real salary.”[39] The public relief jobs program was never subject to any study or expert opinions.

The pubic relief jobs program was criticized by Christian Holm Barenfeld (Moderate Party) when he issued an interpellation that pointed to the fact that the government tried to create jobs in the public sector at a time when the demand for jobs in the low-skilled service sector actually were in stagnation.[40] Instead of enabling the growth of modest service jobs within the private sector for recently arrived immigrants, the program’s purpose is to create tax-funded, public jobs by decree—among the jobs created by the public relief jobs program are the scanning of state archive documents.

A slight variation of the public relief jobs is the ‘compensation for extra service program’ (ersättning för extratjänst). Here, a public employer that haven’t had any downsizing for twelve months is allowed to offer subsidized employment to persons who have already been part of the Job and Development Program (jobb- och utvecklingsgarantin), or is a recently arrived immigrant.

There also exists a possibility for unemployed without prior work experience to participate in training programs for specific professions through trainee jobs (traineejobb), where the government covers eighty-five percent of the total employment cost,[41] a subsidy especially designed for young adults. A similar form of subsidy is the vocational introduction program (yrkesintroduktion), where employers receive compensation for hiring unemployed people without any work experience, given that the employer also provides guidance or education. To be employed under this program you have to be either 15-24 years old without previous employment or older than twenty-five, but unemployed for the last twelve months, or have immigrated to Sweden during the last thirty-six months. This specific vocational introduction program is based on the European Commission Regulation 651/2014.[42]

Finally, there is the special recruitment incentive (särskilt anställningsstöd) put in place in 1997 for employers that actually offer a steady job to participants in the Job and Development Program[43] (regulated in the ordinance (2015:503) on Special Recruitment Incentive[44].) The Job and Development Program is an active labor market policy for unemployed young adults, and was launched by the center-to-right coalition in 2007.[45] According to the latest report by the Swedish Public Employment Service the average cost per month for special recruitment incentives has increased from 8,000 SEK in 2010 to 17,604 SEK in 2015.[46] Nonetheless, the Center Party‘s platform includes an expansion of special recruitment incentives for persons with disabilities in order to achieve a smoother way in to employment in the non-profit sector.[47]

The above summary is not exhaustive. It excludes a variety of programs that are designed to make the unemployed competitive on the job market or help those that for special reasons have not been working for a substantial amount of time. Hence, other forms of de facto subsidies are work-life introduction (arbetslivsintroduktion), the employability rehabilitation program (arbetslivsinriktad rehabilitering), work trial opportunity (prova-på-plats), start-up grant (starta eget-bidrag), occupational rehabilitation (arbetsträning), and etcetera.[48] These have been excluded in the table below since, though they are tax-funded labor market policies, don’t offer recipients actual, tax-funded employment.

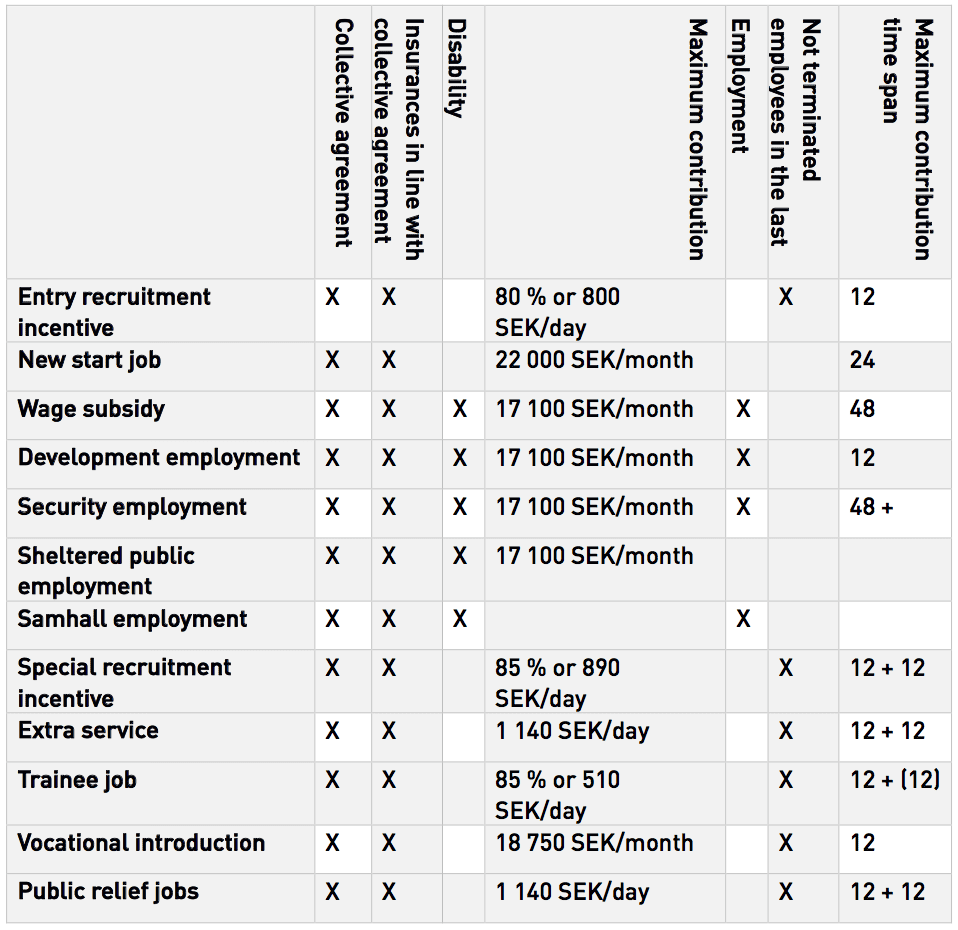

Table 1. Summary of employment subsidies

In total, Swedish government today offers twelve forms of employment subsidies. Two of these were designed to provide employment for recently arrived immigrants. These can, however, also be granted to non-immigrant unemployed. The five wage subsidies concern people with disabilities or reduced work capacity. The remaining subsidies are aimed at long-term unemployed, unemployment among young adults, and recently arrived immigrants. The complexities make it neigh impossible to give a schematic overview or categorization of the various employment subsidies. Thus, the Swedish Public Employment Service doesn’t provide any systematic summary apart from an annual list of the different labor market programs’ individual activities. Worth noting is that every employment subsidy has to align with the demands negotiated by labor unions in their agreements with different employer organizations.

The newest subsidy construct is also the most expensive per receiving individual next to the extra service subsidy. Modern relief jobs grant the employer a maximum of 1,140 SEK/day to be compared with subsidies for people with disabilities where the daily compensation stands between 500 SEK and 890 SEK. In the next section, however, a research summary makes it clear that relief jobs not only are the most costly, but also the least effective to the point where they counteract their very purpose.

According to a Swedish Public Employment Service report, ’Subsidized employments – survey from a sector and company perspective’ (Subventionerade anställningar – kartläggning ur ett bransch- och företagsperspektiv), the number of subsidized individuals has increased from 70,000 individuals in the late 1990’s to more than 140,000 individuals in 2014. This means that the share of subsidized jobs among the totality of employments has grown to 3.3 percent or one job in thirty. It is noteworthy that the majority of subsidized employments exists in sectors with modest jobs where no particular training or education is necessary, e.g. restaurants, house cleaning, retail, wholesale, supermarkets, car shops, and taxi service. In 2014, various bureaucracies made 10,500 separate rulings in the restaurant sector alone on whether different employments were subject to subsidies.[49]

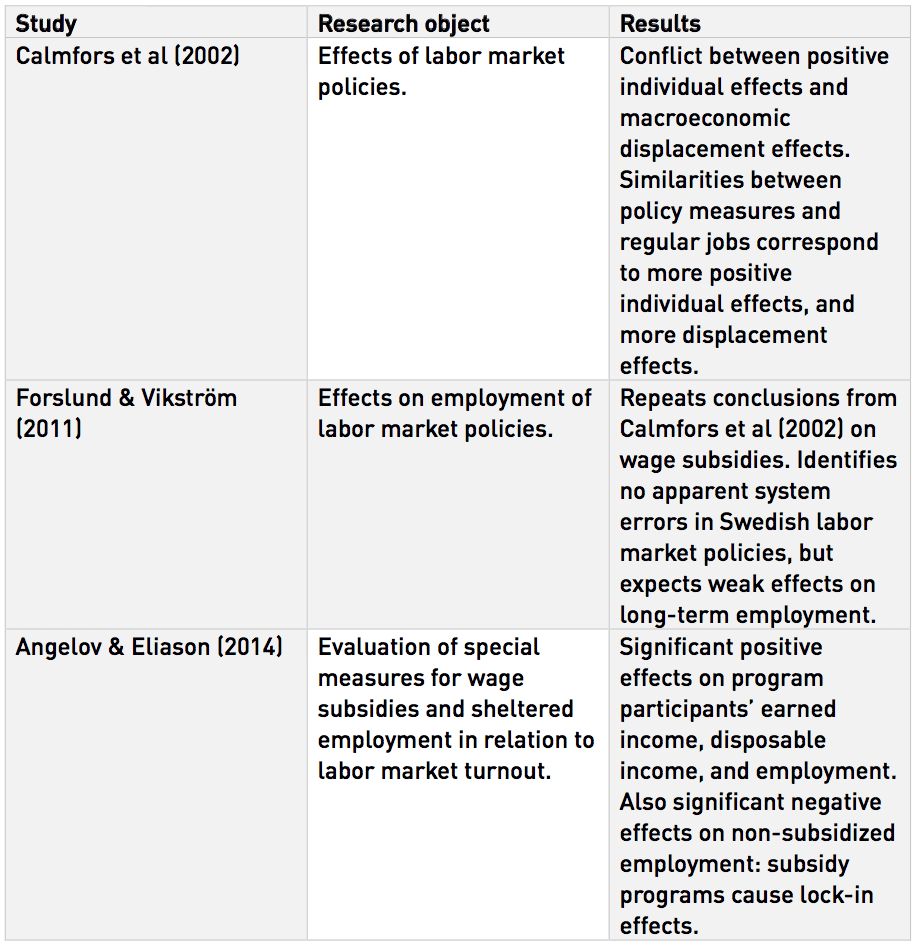

Swedish research studies on employment subsidies

Approximately fourteen percent of employees within the OECD suffer from a self-reported disability, and the cost for programs aimed at people with disabilities is sizable[50]—in Sweden the share of GDP public spending on all forms of incapacity in 2013 constituted 4.3 percent. Only Denmark spends more within the OECD.[51] Since the first half of the 20th century the main argument among economists in favor of employment subsidies has focused on bringing people with disabilities into the work force in order to compensate for national production loss.[52] An oft-made observation has been that these kinds of subsidies can come with a stigma leading to isolation with subsequent lock-in effects. There is always a risk that both the person in search for a job, as well as the Public Employment Service, will lower their aspirations to find non-subsidized employment when there is an easy route to a subsidized alternative.[53]

In 2002, one study presented by the Institute for Evaluation of Labour Market and Education Policy (IFAU), concluded that so-called AMS measures in the 1990’s did not result in any positive workforce participation effects, but did, however, cause counterproductive displacement effects. The study also shows that AMS measures, while technically reducing unemployment thanks to subsidized jobs, should be avoided during recessions as alternatives to standard unemployment benefits. It also argued that active labor market policies ought to target the long-term unemployed rather than young adults.[54]

The study further included an exhaustive summary of previous Swedish studies on employment subsidies. Here, it points to, among others, Sehlstedt and Schröder’s (1989) conclusion that recruitment subsidies have a positive effect only when part of a wider, coordinated program; relief jobs however, has no impact; Edin and Holmlund’s (1991) concludes that relief jobs have a significant negative effect for the individual to find regular employment, but increase the probability for the individual to find a real job after future unemployment. A study by Korpi (1994) makes the obvious observation that relief jobs have a significant positive effect on the duration of subsidized employment. A study by Axelsson et al (1996) notes that the Swedish ALMP known as work-life development (ALU) for practical purposes is identical to relief jobs, and that internships are more effective than both of these alternatives. Harkman et al (1999) similarly argues that recruitment subsidies, trainee replacement schemes, and workplace introduction, result in positive effects on the probability for the subsidized employee to find a regular job within a year after termination. These effects, however, couldn’t be found for relief jobs and work-life development (ALU). Carling and Richardson (2001) and Sianesi (2002) both reach the same conclusion. [55]

The emerging picture regarding the negative effects of early ALMP public relief jobs point overwhelmingly in the same direction and finds strong scholarly support. Also, as noted in the above, public relief jobs is the most expensive policy per individual. Nonetheless, Swedish government is currently reinstating the very same method to counter labor market exclusion—the most likely fate awaiting newly arrived immigrants with permanent resident permit.

A further point by Calmfors et al is that, in contrast to work training programs, subsidized employment leads overall to considerable direct displacement of regular employment. This claim finds evidence in evaluations where intermediaries, providers and participants of subsidized labor programs have been surveyed about the displacement effects. Still, the direct effects are even more wide-ranging than what can be found in such a survey, since market distortion also displaces jobs at workplaces without subsidized employees.

Econometric studies indicate that displacement effects are so exacting that for every three subsidized jobs two regular jobs are displaced. It is thus not surprising that the extensive research summary by Calmfors et al finds no support for the claim that total unemployment is reduced by additional ALMP measures—the only impact on unemployment concerns the technical number where also subsidized jobs are subtracted from the overall employment number. Positive effects on an individual level are primarily detected when it comes to start-up grants, recruitment assistance, workplace introductions (API) and trainee replacement schemes.

The main observation in the Calmfors et al study is the prevalence of conflicting goals with the result that positive individual effects of subsidized employment are limited by macroeconomic job displacement. Ironically, the tendency for displacement effects gets stronger as subsidized jobs get more successful in the sense that they resemble a real job.[56] This observation has been repeated in an IFAU study by Forslund and Vikström (2011): programs that successfully resemble ordinary employment has the most positive effect on individuals, but also create stronger displacement effects.[57]

Since the study of Calmfors et al there has been a steady decrease—from 2,5 percent of GDP in 1996 to 1,4 percent in 2013—in the total expenditure for labor market interventions. However, Sweden still places well above the OECD average. Denmark alone designates a larger share of its public expenditure on ALMP’s, while Norway in 2013 spent only 0,5 percent.[58] Subsidized employment is fairly commonplace. According to a Swedish Public Employment Service study by Eriksson and Pärlemor (2016) almost one in five companies had at least one wage subsidy in 2014.[59]

Table 2. Summary of research on subsidized employment

International research on subsidized employment

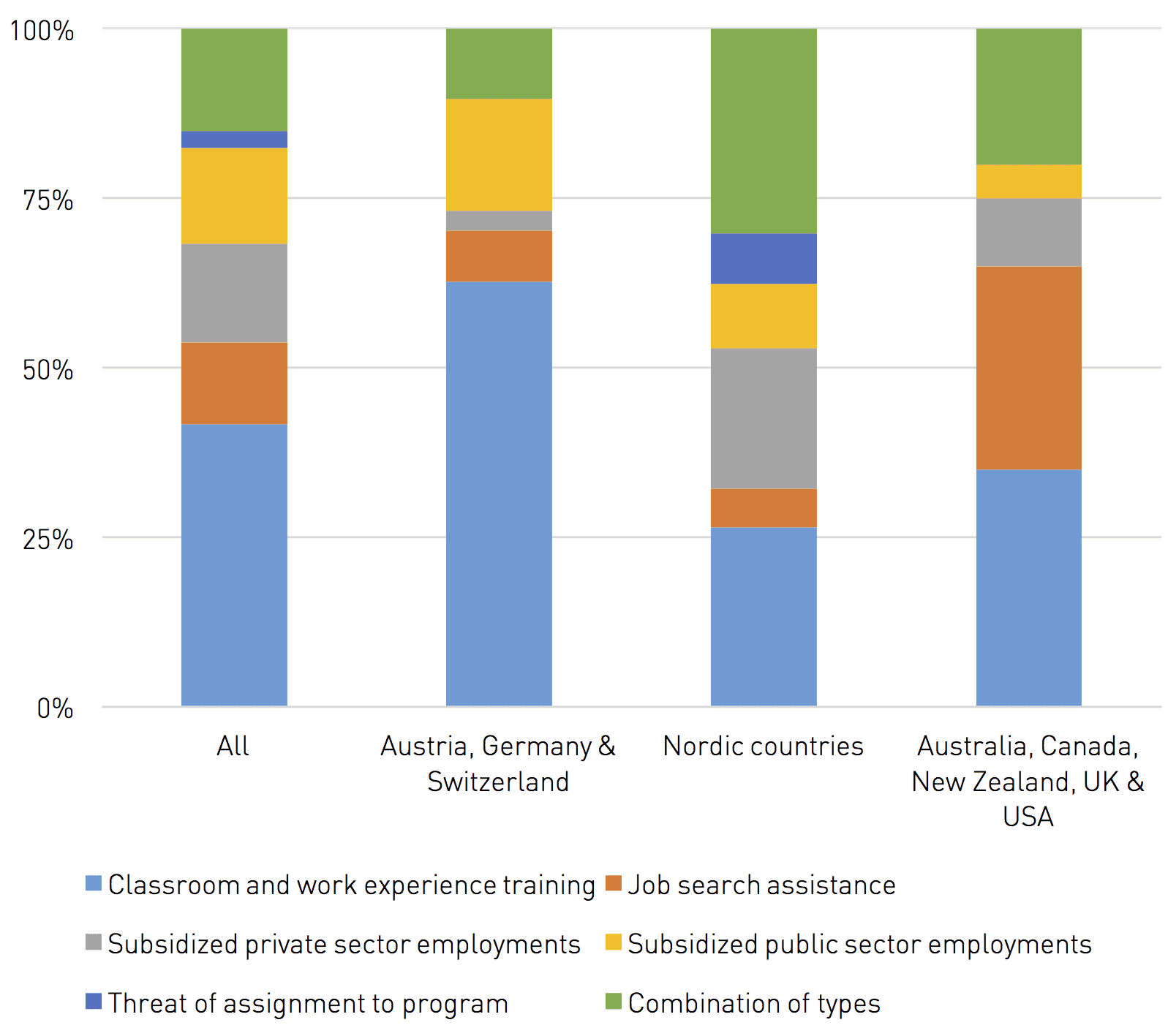

Active labor market policies have long been widely discussed and the emphasis has typically been on German-speaking and Nordic countries. A recent, comprehensive study by Card et al (2010) collected data from ninety-seven studies on ALMP’s from twenty-six different countries.[60] It covered all types of ALMP’s but took a special interest in private as well as public subsidized employment. The result pointed squarely to the conclusion that subsidized employment is relatively ineffective.[61] Diagram 1 consists of data reported by Card et al and shows the shares of total ALMP measures in specific categories of programs.[62]

Diagram 1. ALMPs within different country groups

The Nordic countries stand out as the group with highest percentage of subsidized private sector employment; highest percentage of threat of assignment to programs, and highest percentage of combination of types.

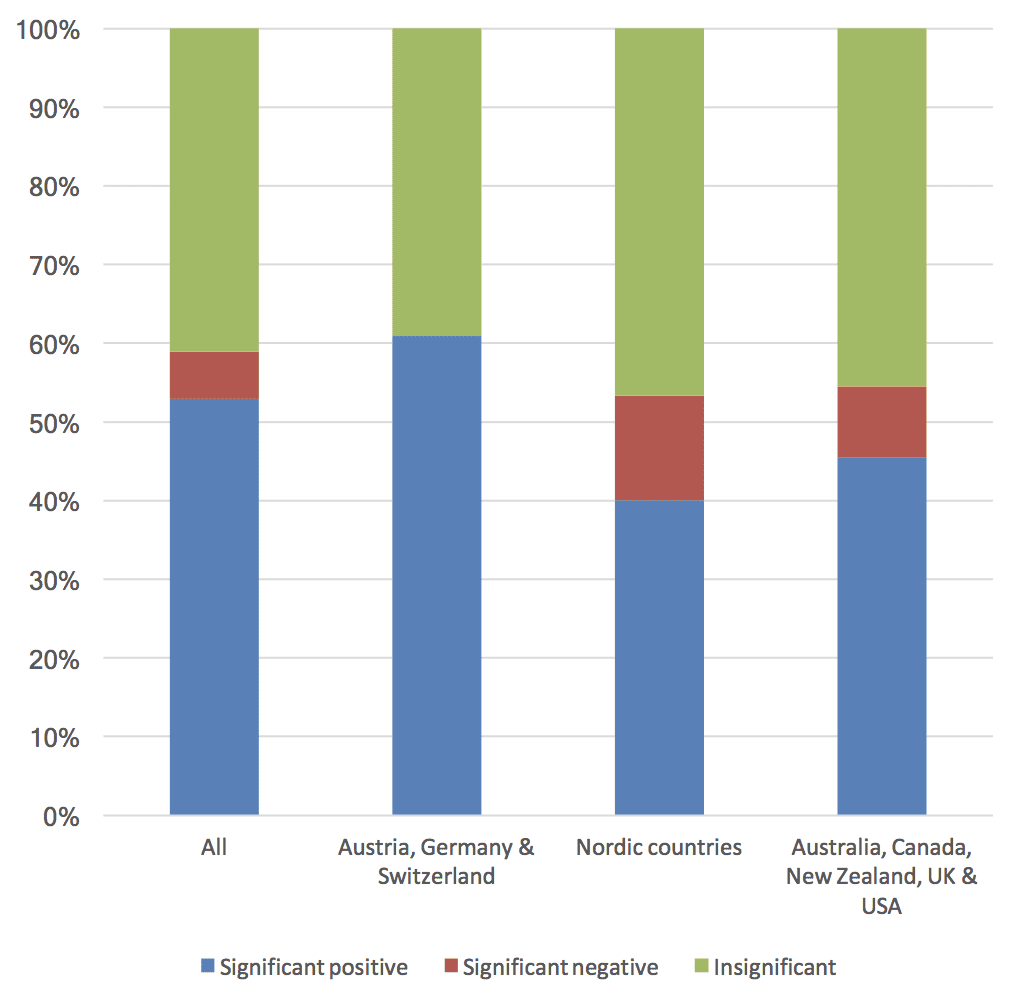

Diagram 2. Long-term effects of ALMP’s by country group

Diagram 2 is based on Table 5 in the Card et al study and summarizes the estimated impact of ALMP’s between the different country groups in the short– (twelve months after the completion of a program), medium– (twenty-four months after completion) and long-term (thirty-six months after completion). Only the estimated long-term impact of ALMP’s is shown here. The estimated impact in Nordic countries is insignificant to 46,7 percent, while forty percent of the effects are significantly positive.

In other words a clear majority of estimates on the impacts of ALMP programs in Nordic countries show insignificant effects, i.e. tax-money spent on programs without long-term effects. It should also be noted that long-term effects has least negative results compared to short– and medium–term, with numbers ranging from 16,6 percent to 30,5 percent negative results across the country groups.

Essentially the only examples where the effects are predominantly significantly positive are the short- and medium-term programs in Anglo-countries, where the effects are to 66,7 percent significantly positive. Long-term effects in German-speaking countries are to 60,9 percent significantly positive.[63] In German-speaking countries, ALMP programs consist predominantly of classroom or work experience training. Anglo-countries focus to sixty-five percent on classroom or work experience training including the added method of job search assistance.

Card et al draws the conclusion that the most effective short-term ALMP is job search assistance, while the least successful of all ALMP’s is subsidized public sector employment (eg. public relief jobs.).[64] This echoes the conclusions in Heckman et al (1999) and Kluve & Schmidt (2002). Note that Nordic countries to a lesser degree than any other offer the most successful ALMP, i.e. job search assistance.

Conclusions and policy proposals

Research shows that subsidized employment in Sweden can have positive individual effects at the cost of displacing real jobs. There are strong negative effects of subsidized employment: three subsidized jobs amount to two real jobs being displaced. Some Swedish studies suggest that methods that succeed in creating subsidized jobs that strongly resemble real jobs have stronger displacement and lock-in effects. This means that individuals with subsidized employment are at risk of getting stuck outside the labor market and remain subsidized even when this is no longer warranted by circumstances.

In terms of international research, Card et al in their summary of ninety-seven independent studies concludes that subsidized public employment is the most ineffective labor market policy, while job search assistance is the most effective. In their repertoire of ALMPs, the Nordic countries have the smallest share of job search assistance. It is also noteworthy that Sweden’s government, despite these findings, recently announced that it will create an additional 5,000 public relief jobs by the end of 2020.

Instead of continuing down the same avenue, Sweden would do well by analyzing its very focus on subsidized employment outside aid for people with disabilities. There are easier ways to create jobs, for example lowering payroll and income taxes to expand the service sector. Since individuals with public relief jobs tend to return to unemployment when the subsidy returns it begs the question what kind of competence these individuals actually acquire. Learning how to scan a document at a public authority hardly leads to future employment outside the realm of subsidized jobs. The gateway to real jobs is rather education towards a craft or academic competence. The chores assigned at public relief jobs simply do not meet the demands on the labor market. The suspicion that public relief jobs programs are created to meet political demands, rather than to create jobs, comes to mind.

In 2014, Swedish service sector association Almega brought forth a proposal that is worth a second look. It takes aim at salary formation on the labor market, and argues that it must be structured in a way that allows entrance into the workforce also for people without education or capacity for high productivity. The alternative is a clear risk that this group finds itself in permanent exclusion. A possible solution could be public-private partnerships for vocational training. When vocational training is used to counter a recession its effects are weak, but it is an effective method for long-term employment and, importantly, doesn’t cause displacement effects.

First and foremost, labor policies should aim at creating jobs in the private sector. The bottom line is that subsidized (as well as non-subsidized) public employment essentially is a tax-funded enterprise. Sweden needs to steer clear of expanding its public sector, with its subsequent tax increases and growing dependency ratio—ultimately paid for by the very private enterprises that are the only force able to create meaningful and real jobs, and help the unemployed to break free from their alienation.

Notes

- European Commission (2016). ↑

- Jansson (2014). ↑

- Angelov & Eliason (2014). ↑

- Arbetsmarknadsdepartementet (2016). ↑

- Card et al (2010); Angelov & Eliason (2014). ↑

- ESV 2015:24, p. 90. ↑

- Statens budget (2017). Utgiftsområde 14. ↑

- Kaldor (1936). ↑

- Angelov & Eliason (2014), p. 8. ↑

- SOU 1975:82, page 69. ↑

- Angelov & Eliason (2014), p. 8. ↑

- Calmfors et al (2002), p. 24. ↑

- SFS 2006:1494. ↑

- Riksrevisionen (2013), p. 5. ↑

- Arbetsmarknadsutskottets betänkande 2013/14:AU10. ↑

- SFS 2006:1481. ↑

- Arbetsförmedlingen (2016), p. 90. ↑

- Riksrevisionen (2013), pp. 11, 33. ↑

- Interpellation 2007/08:299. ↑

- Interpellation 2007/08:547. ↑

- Interpellation 2015/16:182. ↑

- Ds 2016:14. ↑

- Arbetsmarknadsutskottets betänkande 2016/17:AU4. ↑

- Angelov & Eliason (2014), page 6-7. ↑

- Interpellation 2012/13:422. ↑

- SOU 2012:31. ↑

- Arbetsförmedlingens faktablad. Trygghetsanställning. ↑

- SFS 2011:1560. ↑

- SOU 2012:31. ↑

- Arbetsförmedlingens faktablad. Utvecklingsanställning. ↑

- Proposition 1977/78:30. ↑

- Angelov & Eliason (2014), p. 7. ↑

- Arbetsförmedlingens faktablad. Skyddat arbete hos offentlig arbetsgivare. ↑

- Interpellation 2015/16:598. ↑

- Svar på skriftlig fråga 2004/05:959. ↑

- SOU 2014:16, p. 18. ↑

- Regeringsbeslut A2016/02180/A. ↑

- Arbetsförmedlingens faktablad. Lönebidrag. ↑

- Statsrådsberedningen (2016). ↑

- Interpellation 2016/17:161. ↑

- Arbetsförmedlingens informationsblad. Traineejobb. ↑

- Ibid. ↑

- SFS 1997:1275. ↑

- SFS 2015:503. ↑

- SFS 2007:414. ↑

- Arbetsförmedlingen (2016), p. 85. ↑

- Motion 2014/15:2771. ↑

- Arbetsförmedlingen (2016), p.140–141. ↑

- Eriksson & Pärlemor (2016), pp. 14–16, 23. ↑

- Angelov & Eliason (2014b), p. 3. ↑

- OECD, (2013). OECD definition of incapacity: “Public spending on incapacity refers to spending due to sickness, disability and occupational injury. It includes disability cash benefits that are comprised of cash payments on account of complete or partial inability to participate gainfully in the labour market due to disability. The disability may be congenital, or the result of an accident or illness during the victim’s lifetime. It also includes spending on occupational injury and disease, which records all cash payments such as paid sick leave, special allowances and disability related payments such as pensions, if they are related to specific occupational injuries and diseases.” ↑

- Ibid. ↑

- Calmfors et al (2002), p. 1. ↑

- Ibid. ↑

- Ibid, p. 43. ↑

- Ibid, pp. 78–80. ↑

- Forslund & Vikström (2011), p. 55. ↑

- Ibid, page 15; OECD (2017). ↑

- Eriksson & Pärlemor (2016), p. 5. ↑

- Card et al (2010), pp. 455–458. ↑

- Ibid, p. 475. ↑

- Card et al (2010), p. 459. ↑

- Ibid, p. 462. ↑

- Ibid, pp. 453, 467, 475 ↑

References

Angelov, Nikolay & Eliason, Marcus (2014), Lönebidrag och skyddat arbete: en utvärdering av särskilda insatser för sökande med funktionshinder. Report 2014:24. Uppsala: IFAU.

Arbetsförmedlingen (2016). Arbetsförmedlingens återrapportering – Arbetsmarknadspolitiska program. Årsrapport 2016.

Arbetsförmedlingens faktablad, arbetssökande 2017-02. Skyddat arbete hos offentlig arbetsgivare.

Arbetsförmedlingens faktablad, arbetsgivare 2017-03. Trygghetsanställning.

Arbetsförmedlingens faktablad, arbetssökande 2017-03. Utvecklingsanställning.

Arbetsförmedlingens informationsblad, arbetsgivare 2016-11. Traineejobb.

Arbetsförmedlingens årsrapportering (2016). Arbetsmarknadspolitiska program. Årsrapport 2015.

Arbetsmarknadsutskottets betänkande 2013/14:AU10. Subventionerade anställningar för nyanlända.

Arbetsmarknadsutskottets betänkande 2016/17:AU4. Nya benämningar på lönestöd.

Arbetsmarknadsdepartementet (2016), Uppdrag avseende moderna beredskapsjobb i staten. Regeringsbeslut A2016/02180/A.

Axelsson, Roger & Löfgren, Karl-Gustaf (1992), Arbetsmarknadsutbildningens privat- och samhällsekonomiska effekter. EFA-rapport 25, Arbetsmarknadsdepartementet, Stockholm.

Calmfors, Lars, Forslund, Anders, & Hemström, Maria (2002), Vad vet vi om den svenska arbetsmarknadspolitikens sysselsättningseffekter?. Report 2002:8. Uppsala: IFAU.

Card, David, Kluve, Jochen, & Weber, Andrea (2010), Active labour market policy evaluations : a meta-analysis. The Economic Journal, November, 120: 452–477.

Carling, Kenneth & Richardson, Katarina (2001), The relative efficiency of labor market programs: Swedish experience from the 1990’s. Working Paper 2001:2. Uppsala: IFAU.

European Commission (2016). European semester thematic fiche: Employment incentives. 2016 May. Retrieved 2017-04-07: <http://ec.europa.eu/europe2020/pdf/themes/2016/employment_incentives_201605.pdf>

ESV 2015:24. Rapport: Utfallet för statens budget.

Ds 2016:14. Förtydliganden av lönestöden för personer med funktionsnedsättning som medför nedsatt arbetsförmåga.

Edin, Per-Anders & Holmlund, Bertil (1991), Unemployment, vacancies and labour market programmes: Swedish evidence, i Schioppa, Fiorella Padoa (red), Mismatch and labour mobility. Cambridge University Press.

Eriksson, Jan, & Pärlemor, Linda (2016), Subventionerade anställningar : kartläggning ur ett bransch- och företagsperspektiv. URA 2016:5. Stockholm: Arbetsförmedlingen.

Forslund, Anders & Vikström, Johan (2011), Arbetsmarknadspolitikens effekt på sysselsättning och arbetslöshet – en översikt. Report 2011:7. Uppsala: IFAU.

Harkman, Anders, Johansson, Anna & Okeke, Susanna (1999), Åtgärdsundersökning 1998 : åtgärdernas effekter på deltagarnas sysselsättning och löner. Ura 1999:1. Stockholm: Arbetsmarknadsstyrelsen.

Heckman, James, LaLonde, Robert & Smith, Jeffrey (1999), The economics and econometrics of active labor market programs. I: Ashenfelter, Orley & Card, David (red), Handbook of labor economics. Vol 3A. Amsterdam: Elsevier Science BV.

Interpellation 2007/08:299. Om misslyckande för nystartsjobben.

Interpellation 2007/08:547. Om möjligheterna till nystartsjobb och heltidsarbete för deltidsarbetslösa.

Interpellation 2012/13:422. Lönestöd som slår ut ordinarie jobb, lönebidrag och företag.

Interpellation 2015/16:182. Nystartsjobb i småföretag.

Interpellation 2015/16:598. Översyn av Samhall.

Interpellation 2016/17:161. Statliga beredskapsjobb.

Jansson, Li (2014), Vägar till en inkluderande arbetsmarknad. Stockholm: Almega.

Kaldor, Nicholas (1936), Wage subsidies as a remedy for unemployment. Journal of Political Economy, 44(6):721–742.

Kluve, Jochen & Christoph M. Schmidt (2002), Can training and employment subsidies combat European unemployment?. Economic Policy, 35: 409-448.

Kluve, Jochen (2014), A review of active labour market programmes with a focus on Latin America and the Caribbean. Working paper no 9. Geneva: International Labour Office, Research Department.

Korpi, Tomas (1994), Employment stability following unemployment: evidence of the effect of manpower programs for youth. I: Escaping unemployment – Studies in the individual consequences of unemployment and labor market policy, doktorsavhandling, Sofi nr. 24, Stockholms universitet.

Motion 2014/15:2771. Särskilt anställningsstöd för personer med funktionsnedsättning i den ideella sektorn.

OECD (2013). Public spending on incapacity. Retrieved 2017-08-15: <https://data.oecd.org/socialexp/public-spending-on-incapacity.htm>

OECD (2017). Data on active labour market policies – public expenditure on activation policies in 2013. Retrieved 2017-04-07, <http://www.oecd.org/employment/activation.htm>.

Proposition 1977/78:30. Skyddat arbete och yrkesinriktad rehabilitering m. m.

Proposition 2015/16:1. Förslag till statens budget för 2016.

Regeringen 2017. Statens budget 2017 i siffror: utgiftsområde 14, arbetsmarknad och arbetsliv. 2017-04-18. Retrieved 2017-07-09: <http://www.regeringen.se/artiklar/2017/04/statens-budget-2017-i-siffror-utgiftsomrade-14-arbetsmarknad-och-arbetsliv/>

Riksrevisionen (2013), Ett steg in och en ny start : hur fungerar subventionerade anställningar för nyanlända?.

Sehlstedt, Kjell & Schröder, Lena (1989), Språngbräda till arbete? En utvärdering av beredskapsarbete, rekryteringsstöd och ungdomsarbete. EFA-rapport Nr 19, Arbetsmarknadsdepartementet: Stockholm.

SFS 1997:1275. Förordning om anställningsstöd.

SFS 2006:1481. Förordning om stöd för nystartsjobb.

SFS 2006:1494. Kreditering på skattekonto av stimulans till arbetsgivare för nystartsjobb.

SFS 2007:414. Förordning om jobb- och utvecklingsgarantin.

SFS 2011:1560. Förordning om statsbidrag till kostnader för verksamheten Kulturarvslyftet.

SFS 2015:503. Förordning om särskilt anställningsstöd.

Sianesi, Barbara (2001), An evaluation of the active labour market programmes in Sweden. Working Paper 2001:5. Uppsala: IFAU.

Sianesi Barbara (2002), Differential effects of Swedish active labour market programmes for unemployed adults during the 1990s. Working Paper No. 2002:5. Uppsala: IFAU.

SOU 1975:81 Organisation för skyddat arbete.

SOU 2012:31 Sänkta trösklar, högt i tak. Arbete, utveckling, trygghet.

SOU 2014:16 Det ska vara lätt att göra rätt.

Statsrådsberedningen (2016), Moderna beredskapsjobb i staten. Promemoria

Svar på skriftlig fråga 2004/05:959. Om Samhall.