Should unfairness be maintained in corporate taxation?

A vast body of research shows that workers bear most of the burden of the corporate income tax – at least half. However, this fact is almost always overlooked in the current EU and OECD discussions about the taxation of multinational and digital firms. Also, if taxing rights were shifted to countries where consumers are located, workers would have to pay taxes to governments that do not represent them.

Abstract

Some governments are concerned about the impact of digitalisation on revenues from taxes on corporate income. At the same time, governments and international organisations remain ignorant to the distributional implications of corporate taxes – the so-called corporate tax incidence. A vast body of economic research demonstrates that workers bear more than 50 per cent (sometimes more than 300 per cent) of the corporate tax burden, and empirical research suggests that low-skilled, young and female employees bear a larger share of the corporate tax burden. Due to the tax incidence, the opaqueness and heterogeneity of corporate income tax law and multiple double taxation effects, it is impossible to objectively measure the real tax burden that is carried by individual citizens. In other words, it is unacceptable to maintain corporate taxes if the political objective is to achieve more transparency and more (perceived) fairness in taxation.

Despite the vast empirical evidence about the significant distributional consequences of taxes on corporate income, neither the European Commission nor the Organisation for Economic Cooperation and Development (OECD) consider the tax incidence in their policy documents. The failure to recognise the empirical evidence on the tax incidence undermines the bureaucratic and political accountability in fiscal policymaking. Any corporate tax reform, including digital services taxes (DSTs), minimum corporate income taxes and the reallocation of global taxing rights, must be assessed by its distributional implications. The abolition of tax competition, as suggested by some European Union (EU) and OECD policymakers, would cement corporate tax-induced wage depression and shield opaque corporate tax regimes that are incomprehensible for most taxpayers and politicians (tax obfuscation).

A reallocation of tax revenues to countries where consumers are based would imply that the greatest part of the reallocated tax revenue would be borne by workers of exporting companies financing foreign governments that do not represent them. Even if some governments enjoy a net increase in government revenues from new corporate tax base allocation rules, the additional tax revenues would not be enjoyed by those workers that pay taxes to foreign governments and, accordingly, suffer from lower wages or lower wage growth.

Two of the world’s largest consumer markets, China and India, are subject to high degrees of state interventionism. Due to the tax incidence, workers of companies in market economies would indirectly subsidise state-owned enterprises (SOEs) in these countries (and other recipient countries). In other words, corporate taxation according to where users/customers are based would result in indirect subsidies paid by market economies to interventionist countries’ state-owned enterprises with whom they may even compete.

Estimates suggest that the implied gross tax subsidy paid by European workers to foreign governments would amount to more than 91 billion USD annually (not taking into consideration the possible reallocation of foreign exporters’ profits to European tax bases). The implied gross tax subsidy paid by European workers to the government of China, for example, amounts to more than USD 3.5 billion per year, with German workers alone accounting for about USD 1.2 billion annually. The OECD-proposed subsidy scheme brings to the fore a number of critical concerns that have for a very long time occupied international trade diplomacy. These concerns go beyond the mere role of government intervention in international trade, e.g. through subsidies and tax credits. They are about democratic legitimacy and representation, and governments’ respect for human rights and the freedom of speech. Neither the OECD nor the EU and national governments have so far provided assessments of the tax incidence. Nor have they analysed the social and human rights impacts of their proposed corporate tax reforms.

1. Introduction

On 25 May 2019, International Monetary Fund (IMF) Managing Director Christine Lagarde stated that ‘[t]he public perception that some large multinational companies pay little tax has led to political demands for urgent action. It is not difficult to see why.’ (IMF, 2019a)

No doubt, there is a long-standing perception among citizens and policymakers across the world that multinational companies do not pay their fair share of tax. And yet, despite Mrs Lagarde’s concerns about ‘tax avoidance, tax revenues and some large digital companies,’ her political remarks are misleading and politically inappropriate. The corporate tax literature demonstrates that it is impossible to make any informed judgements about fairness in corporate taxation.[1] Corporate tax law is problematic in many respects. Tax policymakers have been repeatedly plugging alleged holes but in fact maintain a legal hydra that creates more problems than it solves. Due to the tax incidence, the complexity of corporate income tax law and multiple double taxation effects that arise from corporate taxation, it is not possible to objectively measure the real tax burden that is carried by individual taxpayers. It is therefore impossible to maintain corporate tax regimes if the political objective is to achieve more objectivity and more perceived fairness in taxation.

Tax obfuscation at EU and OECD level

Corporate income taxes are at the heart of numerous inefficiencies. They are at the root of double taxation for multiple sources of individual incomes. As a result of the economic incidence, taxes on corporate income depress the real income of workers, consumers and entrepreneurs. Paradoxically, due to the positive impact on progressivity in the overall tax system, more tax avoidance by corporations would have a positive impact on households’ disposable incomes. Nevertheless, as will be shown below, policymakers still mainly care about defending governments’ tax revenues rather than the often-stated objective to achieve more fairness in taxation on the basis of more transparent and more objective tax regimes.

All this gives reason to doubt high-level political statements about fairness in corporate taxation. In fact, complex and non-transparent corporate income tax laws systematically distort citizens’ perceptions of the amount of taxes they personally pay and tax fairness respectively – a phenomenon that is known as ‘tax obfuscation’. Inconsistent notions about ‘tax avoidance’, ‘tax evasion’ and ‘tax fairness’ demonstrate that the existing system of corporate taxation, as it is enforced in most countries across the globe, is broken and in need of substantial reform.

Misguided notions of tax fairness are still at the heart of contemporary debates on tax reform, e.g. recent calls in the EU and elsewhere for special taxes (sometimes called penalty taxes) on successful digital services companies. The same applies for the OECD’s broader initiative to rewrite the rules of the international corporate tax regime: Under the auspices of the ‘inclusive framework’ representing 129 sovereign governments and territories, the OECD’s Task Force on the Digital Economy (TFDE) has been suggesting a fundamental change to long-established corporate income tax rules. As of July 2019, it is difficult to predict the precise impacts of what has been proposed by the OECD’s tax planners. The least that can be said is that the OECD tabled a number of rather premature ideas that, if they were adopted, would render corporate taxation more complex and less objective (see discussion below). Many observers indeed warn that a reform on the basis of these ideas would render international corporate tax codes more intricate and arbitrary, thus making the system riskier and costlier for companies trading and investing across national borders.[2]

Corporate tax: a tax most harmful to economic activity and government accountability

In the past, the OECD actually recognised that taxes on corporate income are most harmful to the creation of value added and commercial activities as they ‘discourage the activities of firms that are most important for [economic] growth: investment in capital and productivity improvements’. (OECD, 2010, p. 22). With the current trend, however, the OECD argues that a considerable challenge for governments arising from the digitalisation of the economy relates to the question of how taxing rights on corporate income generated from cross-border activities should be allocated among governments. EU policymakers follow suit, highlighting the need to reallocate corporate tax revenues. While the mere size of tax revenues currently dominate at EU and OECD levels, economic consequences and, importantly, distributional implications on individual citizens hardly play a role. The question about who is really bearing the burden of taxes on corporate income, the so-called corporate tax incidence, is supressed in corporate tax reform debates.

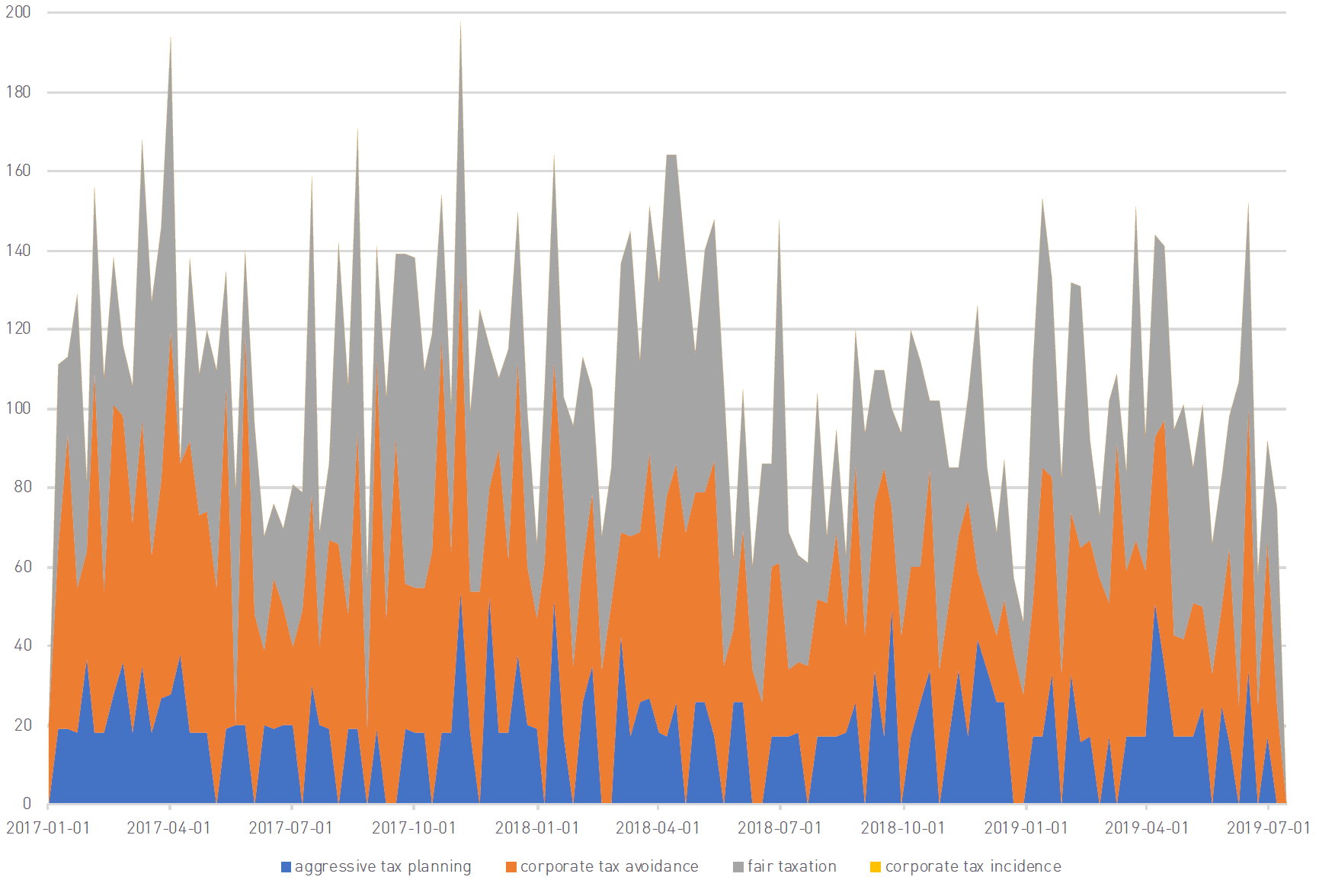

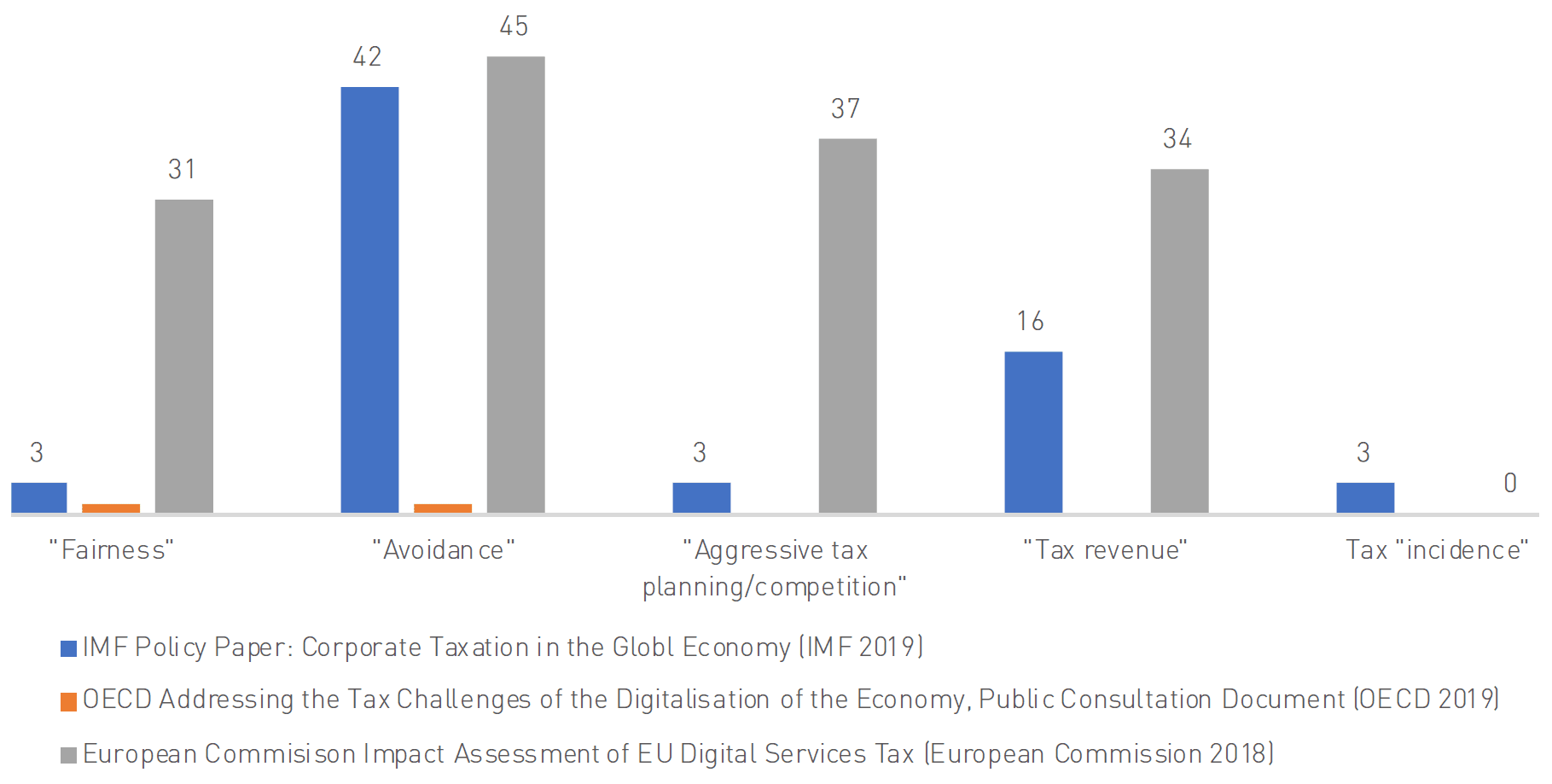

As outlined by Figure 1, terms like ‘aggressive tax planning’, ‘corporate tax avoidance’ and ‘fair taxation’ are dominant in the public debate about corporate taxation. At the same time, there is only very little public awareness and/or interest in the ‘corporate tax incidence’. Numbers provided by Google Trends indicate that there is currently no public interest in the incidence effects of taxes on corporate income. Indeed, both the knowledge and concerns about the tax incidence are rare even among tax activists, public officials and elected lawmakers (see section 3.1 for a discussion). Despite vast economic evidence about the significant distributional consequences of taxes on corporate income, which will be addressed below, this asymmetry is reflected by major recent EU, IMF and OECD publications on corporate tax reform. As shown by Figure 2, EU, IMF and OECD officials are mainly concerned about governments’ future ‘tax revenues’ and ‘tax avoidance’. The term ‘tax incidence’ is only mentioned three times in a publication released by the IMF in 2019 on the future of corporate taxation in the global economy (total number of words: 36,313). At the same time, neither the European Commission’s impact assessment on the digital services tax (67,151 words) nor the OECD’s recent consultation document on international corporate tax reform (14,382 words) contain the word ‘incidence’. Importantly, contrary to the IMF and the OECD, the European Commission’s tax policy department (over-)emphasises the issue of ‘tax fairness’, but does not mention ‘tax incidence’ once. The rather systematic disguise of tax incidence effects undermines the institutional credibility of these institutions, particularly that of the European Commission, whose understanding of fairness is dubious. The failure to recognise the existence and empirical evidence on tax incidence undermines the bureaucratic and political accountability in fiscal and economic policymaking.

Figure 1: Lack of public awareness of distribution of real burden (tax incidence effects) of corporate taxation

Figure 2: Ignorance of distribution of real burden (tax incidence effects) of corporate taxation in major EU, OECD and IMF publications

No analysis of the economic and social implications from the reallocation of tax rights by the OECD

In the EU, the governments of Denmark, Finland, Ireland an OECD AND EU IDEAS FOR THE REFORM OF d Sweden opposed new taxes on digital services (DSTs), forcing European finance ministers to focus instead on the OECD’s ongoing work on international tax reform. The OECD’s latest policy ideas, which were vaguely outlined in February 2019, go well beyond the scope of companies with digital business models. What started as a coordinated attempt to address certain ‘tax challenges of the digitalisation of the economy’ (OECD, 2019, 2015a, 2015b) has now turned into a multilateral effort to overturn the sovereign right of individual jurisdictions to tax income originating within their own borders. The implementation of the OECD’s ideas could result in a profound reallocation of international taxing rights and tax revenues generated from internationally operating companies, irrespective of whether these companies are traditional or digital.

Civil society groups as well as tax justice advocates generally welcome the OECD challenging the current distribution of international taxing rights (see, e.g., TJN, 2019). Most of them were also in favour of the EU’s attempt to impose taxes on digital services. However, technical input to the discussions on tax reform is mainly provided by public academics, tax advisory companies and finance ministries. Many point to an overall positive impact on the future efficiency and future fairness of the tax system. However, the political economy of interest groups, i.e. groups and individuals’ own economic incentives to provide political decision-makers with certain policy-relevant advice, suggests that technical guidance from some of these groups should be treated with caution. Tax practitioners and legal experts provided much feedback. Yet, criticism mainly addressed certain technical details rather than the wider economic, social and political implications of the measures proposed by the OECD.

Most corporate tax experts, including public academics, representatives of finance ministries and the EU’s and OECD’s tax officers, do not question the expediency of taxes on corporate income. The same applies for tax law practitioners who are influential stakeholders in the tax reform debate (see, e.g., CEO, 2018). However, governments should be concerned about the distributional consequences of taxes on corporate income. It is, after all, individual citizens in their capacity as workers, consumers, entrepreneurs and investors who suffer from significant distributional consequences: Taxes on corporate income suppress citizens’ real incomes through lower wages, higher consumer prices and lower capital income.[3]

This paper is an attempt to balance and advance the debate on international corporate tax reform. Recognising that there is some political appetite to explore new forms of more transparent taxation that are fit for the digital age, this paper is also an attempt to remind policymakers that taxes on corporate income have a depressing effect on citizens’ real disposable incomes, future investment and future innovation. The paper will highlight that the overall financial burden of corporate taxes is borne by all those who are already legally obliged to pay direct taxes on labour income (income tax), personal consumption (sales taxes, VAT) and capital income (capital income taxes). Acknowledging the fundamental link between taxation and democratic representation, it will be argued that tax competition is a necessary condition for governments willing to enforce tax policies that are considered fair by their local populations.

Section 2 outlines recent OECD and EU ideas for the reform of international corporate tax rules. Section 3 details the tax incidence literature. Due to the extensive coverage in the academic literature, particular attention will be paid to the incidence of taxes on corporate income that is borne by workers. Section 4 provides some back-of-the-envelope estimates for the corporate tax-induced burden that is borne by workers in OECD countries. Acknowledging the essential link between taxation and democratic representation, on the one hand, and the OECD’s commitment to private sector-driven (market) economies on the other, estimates will be provided for the part of the incidence that workers in market economies would transfer to the governments of China and India, two populous countries that are known for high degrees of state interventionism and high levels of state-owned enterprise engagement. Section 5 concludes with a discussion on how tax competition can advance government accountability in tax policymaking, contribute to due tax transparency – in favour of tax regimes that are considered fairer by larger parts of governments’ local constituencies.

2. OECD and EU ideas for the reform of international corporate tax rules

The OECD’s ‘Addressing the Tax Challenges of the Digitalisation of the Economy’ initiative

The OECD’s recent consultation document outlines several proposals grouped under two categories: revised profit allocation and nexus rules (pillar 1) and a global anti-base erosion proposal (pillar 2). Regarding the ‘broader tax challenges proposals to revise nexus and profit allocation rules’, the OECD laid out three policy ideas:

- Taxation according to user participation;

- Taxation on the basis of so-called marketing intangibles;

- Taxation of operations of ‘significant economic presences’.

As a result of continued concerns about corporate tax base erosion, which were already addressed by the OECD’s recent base erosion and profit-shifting (BEPS) measures, the OECD is also taking into consideration a ‘global minimum corporate tax regime’. The full list of the major features of the proposals, as stated in the consultation document, are summarised in Table 1 in the Appendix.

For now, following the responses to the OECD’s recent consultation, suffice it to say that internationally operating companies are alarmed.[4] Most businesses are actually in favour of greater levels of harmonisation of national tax codes. The current system, a complex patchwork of highly diverse national tax laws and international tax treaties, causes high compliance costs. It also comes with substantial legal risks for businesses that trade and invest across borders. Following the proposals, businesses are concerned that at least some governments agree on rules that would further increase their overall tax burden, resulting in new legal uncertainties and significantly higher tax compliance costs.

Companies’ concerns are legitimate. Governments’ appetite for higher tax revenues has generally been strong in the past. Regarding taxes on corporate income, statutory corporate tax rates in OECD countries have indeed decreased since the 1970s, but governments’ revenues from corporate income taxes actually increased. Since the mid-1990s, revenues from taxes on corporate income even grew at rates exceeding the growth of tax revenues from other sources (see, e.g., Bauer, 2018). Moreover, governments across the world are increasingly looking for new ways to collect additional taxes from foreign companies that operate in their territory without having a taxable presence in their countries. This is reflected by numerous disputes over the allocation of international companies’ taxable income, e.g. tax avoidance allegations (see, e.g., Álvarez-Martínez et al., 2018; Andersson, 2018), the EU’s Digital Services Tax initiatives (see below) or the EU’s multiple state-aid cases (see, e.g., European Commission, 2019), and the European Commission’s ‘Task Force on Tax Planning Practices’ to investigate the discriminatory tax ruling practices of EU Member States.

The OECD seems to be guided by the willingness to further increase tax code complexity. While OECD policymakers initially indicated not to ringfence certain industries with respect to different tax treatment, a recent consultation document suggests not only to ringfence highly digital business models, but also ‘consumer-facing industries’.[5] It is hard to see where lawmaker can draw a line on the basis of non-discriminatory rules. And it is hard to see how businesses with comply B2B and B2C value chain can comply with such regulations without running into legal risks.

Some governments have pre-empted the OECD’s reforms by promoting new forms of corporate taxation based on ideas regarding ‘user participation’ or ‘marketing intangibles’, i.e. certain non-physical assets owned by a firm, which are likely to disproportionately benefit the governments of countries with large populations, e.g. China and India.

However, achieving full consensus is difficult. It is unlikely that all 129 governments will find a consensus on the OECD’s latest ideas. For instance, while the OECD’s Pillar 2 proposals were initially supported by Germany and France, the suggestions offered under Pillar 1, i.e. the allocation of more corporate profits to the countries or markets of online users, have generally been supported by the governments of India, the UK and the USA.

Furthermore, the EU’s experience demonstrates that governments are sharply divided on corporate tax matters. Even if some international agreement is reached, many uncertainties will remain on how the recommended measures will be legislated from one jurisdiction to another. And while many uncertainties remain as to the precise shape of the OECD’s ideas, it should be noted that, as of June 2019, the OECD had not provided any publicly available impact assessment for its proposed measures. Neither had they provided estimates regarding the country-specific tax bases shifted from one government to another (e.g. on the basis of users’ locations or economies’ endowment with marketing intangibles). Nor had they addressed the tax incidence, i.e. the distributional consequences of the proposed taxes for individual citizens in their capacity as workers, consumers, entrepreneurs and investors.

The EU’s Digital Services Tax (DST) proposal

Some European policymakers have for a long time been calling for a certain degree of minimum taxation in the EU, obliging internationally operating companies to pay at least some tax in EU countries. Following a EU-wide attempt to introduce special taxes on the revenues of some digital services companies, some EU governments are now contemplating national digital services taxes (DSTs). The French government has already imposed a narrowly defined DST (the Senate of the French Parliament passed the legislation on 11 July 2019). Its final version excludes French and European companies.[6]

The DST initiative became the EU’s most significant attempt to reform parts of the Member States’ corporate income tax legislation. Several EU efforts, such as the Common Consolidated Corporate Tax Base (CCTB) or the Consolidated Corporate Tax Base (CCTB), aimed to largely eliminate discretionary corporate tax policies within the Single Market, but didn’t attract support from Member States.

In March 2018, the European Commission presented a two-part proposal for a EU-wide DST. Under this proposal, a digital platform company would be deemed to have a taxable ‘digital presence’ or a virtual permanent establishment if its revenues exceed a threshold of EUR 7 million in annual revenues in a Member State, it has more than 100,000 users in a Member State in a taxable year, or more than 3,000 business contracts for digital services between the company and business users per annum. The Commission’s second, interim or temporary plan, aimed at a harmonised EU-wide DST in the absence of a global (OECD) agreement. It suggested a 3 per cent tax on gross revenues earned in the EU. The tax would apply to revenues created from certain digital activities, which the European Commission thinks escapes Member States’ current corporate tax rules. Taxing revenues is a rather unusual practice. With the DST, the European Commission fundamentally deviates from the internationally recognised principle to tax companies’ net income (i.e. in simple terms, revenues minus costs).

The tax is intended to apply to revenues created from selling online advertising space, digital intermediary activities, which allow users to interact with other users and which can facilitate the sale of goods and services between them, and revenues created from the sale of data generated from user-provided data. Under the second part of the proposal, companies with total annual worldwide revenues of at least EUR 750 million and EU revenues of EUR 50 million would be required to pay the tax. Tax revenues would go to the Member States according to where the users are located.

In November 2018, the European Commission, largely supported by the European Parliament, was aiming for a consensus in the Council on these proposals. However, some Member States strongly opposed the Commission’s proposals. In December 2018, the Austrian EU presidency suggested targeting revenues from the supply of digital services where users contribute to the process of value creation. It did not find consensus in the Council. Another recommendation by France and Germany to target only advertising services was also rejected. The Council did not reach an agreement at the March 2019 meeting of EU finance ministers. Compromise proposals put forward by the governments of Austria, France and Germany were also rejected.

Various EU governments (formal opposition to the EU-wide DST mainly came from Ireland, Luxembourg, Denmark and Sweden) are still dismissive of the idea of taxes on certain digital services. Many also oppose EU efforts on corporate tax base harmonisation across the EU. EU policymakers have been struggling for many years to find a compromise regarding the introduction of a Common Corporate Tax Base (CCTB), followed by a Common Consolidated Corporate Tax Base (CCCTB). At the same time, many EU governments strongly advocate corporate tax reforms to take place at the OECD level. Despite these developments, some EU Member States have announced or already put in place unilateral taxes on certain digital services (see Table 3 in the Appendix). These governments argue that their national DSTs would be temporary only until new OECD recommendations are implemented. Yet, not all governments have explicitly stated as such. In the UK, for example, businesses have been urging lawmakers to ensure that an expiry clause is inserted into their general ‘digital legislation’.

Tax avoidance vs. tax incidence

The European Commission and many national EU governments argue that ‘tax avoidance’ by multinational corporations is a problem for society at large. In addition to that claim some EU governments call for a tax system that (somehow) captures the value of user/customer data. Continuing calls from the European Commission as well as the European Parliament indicate that the debate about corporate tax reform in general and special taxes on a selective list of digitalised companies are not going to disappear any time soon.

Calls for minimum (effective) corporate taxes rates[7] on the one hand, and requests for an entirely new type of taxes for a discriminatory list of large digital companies on the other, distract public attention – and political capital – away from the need to fundamentally reform national corporate tax laws to achieve a simpler, more transparent and more efficient corporate tax system in the near future.

For example, larger technology-driven companies, including those headquartered in the EU, would suffer from a more fragmented, more complex, more costly and more unpredictable tax landscape. Many companies are already concerned about an uneven implementation of the wider BEPS recommendations, which are key challenges multinational companies face today. The proliferation of unilateral gross revenue-based DSTs would significantly distort competition, international trade and international investment. The US government’s harsh criticism of the French DST bears a realistic risk of retaliatory trade policy measures, which would cause additional economic distortions. Indeed, in July 2019 the United States Trade Representative (USTR) launched a formal Section 301 Investigation of France’s Digital Services Tax to address whether the French DST is unreasonable or discriminatory and the extent to which the French DST burdens or restricts US commerce (USTR 2019). At the same time, ‘profit shifting’ and ‘market dominance’ get intertwined in a way that distorts the public debate. It is important for policymakers to separate the debate over whether large digital companies pay their fair share of tax from whether they are too large per se, and therefore require attention from, for example, the European Commission and national competition authorities.

3. The tax incidence: how it impacts on workers, consumers, entrepreneurs and investors

Tax incidence neglected in the debate about corporate tax reform(s)

In its 2017 report Tax Policies in the European Union, the European Commission (2017) argues that a tax system is only fair and efficient if it contributes to ‘investment and job creation, corrects inequalities, supports social mobility and achieves high levels of compliance’. As concerns the revenue side, the Commission acknowledges that there can be a trade-off between goals of efficiency and fairness. The Commission’s reasoning is largely confirmed by the OECD, whose multilateral initiatives under the auspices of the Inclusive Framework, particularly the OECD’s BEPS initiative, aim to address companies’ ‘tax planning strategies that exploit gaps and mismatches in tax rules to artificially shift profits to low or no-tax locations where there is little or no economic activity’.

Even though in the past both the EU and the OECD recognised the efficiency losses that result from taxes on corporate income, they (so far) did not provide appropriate impact assessments for their proposed policies. As a result, the current political debate is almost exclusively about technical legal details, whose future impacts on companies’ international tax planning strategies are disputed. Efficiency and income distribution considerations hardly play a role in the OECD’s proceedings. The neglect of the incidence of corporate taxes has wide implications on economic efficiency and citizens’ perceptions of tax fairness. As recently outlined by Baert et al. (2019) in a study for the European Economic and Social Committee (EESC), ‘[t]he risk is that whilst public debate remains uninformed about the importance of tax incidence, tax policy making will remain suboptimal in terms of its impact on employment and growth, if policymakers, either through ignorance or convenience ignore the importance of incidence.”

While impact assessments are not (yet) available for the OECD’s policy ideas, unambiguous lessons can be drawn from the European Commission’s DST initiative: the tax department of the European Commission published an official document entitled Impact assessment. However, that paper reads like a political manifesto against corporate tax avoidance and the commercial use of data by large companies. Importantly, the Commission failed to provide an assessment of the policy implications for businesses, workers, consumers and entrepreneurs. Accordingly, the European Commission’s Tax Department (DG TAXUD) was formally admonished by the EU’s own Regulatory Scrutiny Board (RSB, 2018) for not providing a proper impact assessment. DG TAXUD’s document does not provide any information that is needed to assess the effects intended by policymakers. Generally, the document also fails to assess the impacts on (perceived) fairness in corporate taxation and the distributional consequences resulting from a reallocation of tax base to the EU. With regard to the technicalities of the DST, the Commission blanked out the distributional implications on different actors of the economy that would result from new taxes on certain digital services. As a result, the European Commission’s reasoning underlying a EU-wide DST suffers from various logical inconsistencies. As outlined by Copenhagen Economics (2018, p. 1), the European Commission’s own assessment merely ‘relies on three arguments for the digital tax [that] we find contrasting with empirical evidence and solid economic reasoning’.[8]

Most notably, DG TAXUD’s impact assessment document does not address the critical issue of tax incidence, i.e. the questions about who is effectively bearing the financial burden of special taxes on digital services. The European Commissions’ tax officials thereby ignore that incidence analysis is an indispensable task for those aiming for a system of fair taxation, and a system that is considered fair by governments’ national constituencies respectively. As a result of that, the European Commission’s tax policy agenda is characterised by a bias that has long shaped political debates on corporate tax reform. This bias is shared by organisations that have a strong impact on media coverage and public opinion. As cautioned by Baert et al. (2019, ‘[s]ome organisations similarly dismiss the idea of incidence, despite the academic evidence […]’. For example, the Tax Justice Network in its publication Ten Reasons to Defend the Corporation Tax calls the incidence argument ‘a hoax’ (Tax Justice Network, 2015). In addition, Oxfam noted that taxing companies is ‘one of the most progressive forms of taxation’ (Oxfam, 2014). Similarly, Eurodad (2017) ‘dismissed the idea of a link between corporate taxes and the income of workers or consumer price levels’. It should be noted that, according to the EU’s Transparency Register, Oxfam, Eurodad and the Tax Justice Network receive financial funding from the European Commission, which may have an impact on these organisations’ political advocacy activities.[9]

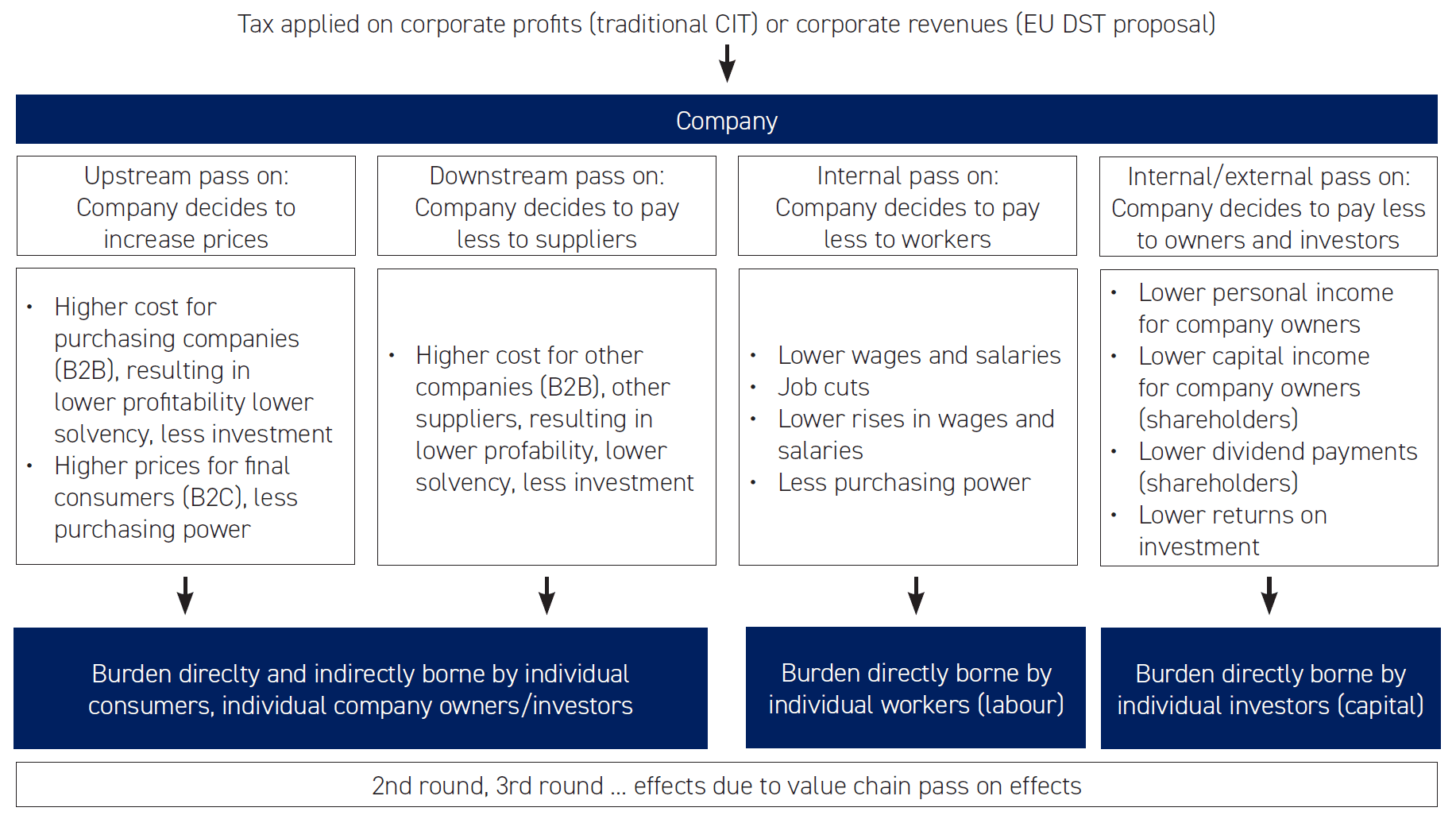

Incidence analysis is about the question of who is bearing the financial burden of a tax. There is broad agreement among policymakers that the incidence of sales taxes falls on consumers. There is also agreement that the incidence of property taxes falls on the owners of real estate. The economic tax incidence in the area of corporate taxation refers to the fact that the real financial burden of a tax is not borne by the company (e.g. an incorporated entity, a partnership) on which the tax is imposed under legal statute. Economic theory, as well as empirical evidence, demonstrates: a tax imposed on companies is directly and/or indirectly shifted onto others in the economy, e.g. suppliers and (B2B) customers, and finally borne by individual (final) consumers, workers, entrepreneurs and investors.

With regard to the incidence of taxes on corporate income, policymakers, civil society representatives and journalists usually assume that the tax incidence falls exclusively on company owners or, as frequently stated, shareholders. Indeed, political party programmes, position papers and media coverage suggest that policymakers involved in the discussions about tax reform disregard the vast body of literature that concludes that the largest share of the incidence of taxes on corporate income falls on workers. As argued by Fuest et al. (2018, p. 1) ‘[a]ccording to surveys, most people think that capital owners bear the burden of corporate taxation’. At the same time, there seems to be a wide range of views among public economists about the allocation of the incidence of taxes on corporate income: Public economists surveyed by Fuchs et al. (1998) state on average that 40 per cent of the corporate tax incidence is on capital (i.e. individual business owners, shareholders, investors), leaving a substantial part of the burden for individual workers, landowners and consumers. However, in this survey, one quarter of the surveyed economists stated they believed that the share borne by capital was below 20 per cent, while another quarter believed the share to be 65 per cent or higher.

The lack of political recognition of the distributional implications, e.g. overall tax progressivity effects, from tax incidence effects is somewhat of a paradox. Generally, tax incidence effects are not difficult to comprehend. Although incorporated entities (or individual ‘owners’ of partnerships) act as legal taxpayers, they do not actually bear the burden of taxes on corporate income. The actual financial burden is shifted partly, entirely or in some cases more than 100 per cent (over-shifting) to other payers than the legal taxpayers. As outlined by Melinez (2017, p. 5) in a recent OECD Working Paper, ‘[c]are should be taken in interpreting [legal tax liability and legal remittance responsibility], which should be understood against the backdrop of the issue of economic incidence’. Melinez also outlines that ‘[t]he statutory incidence and remittance responsibility may have little relationship to economic incidence’ and that ‘it is crucially important to distinguish between the individual or entity that remits the tax and the individual that bears its economic burden’ (p. 8).

The distributional implications arising from the corporate income tax incidence

The amount of literature focusing on the incidence of taxes increased since the mid-1990s. While the public debate is still driven by other (political) considerations, predominantly tax revenues, economists have built a vast reservoir of knowledge about the incidence of specific corporate taxes. Recognising the importance of this issue for policymakers, it is surprising that the tax incidence is only rarely addressed in the public debate and hardly covered by media representatives. One explanation is that, as concluded from an analysis conducted by Fuchs et al. (1998), the relation between value judgments and policy preferences for public economists is ‘much stronger’ than is the relation between the relevant economic parameters and policy choices (for a similar analysis, see also Mayer, 2000).

The political debate about the EU’s DST is a case in point. As concerns the incidence of the DST, the European Commission and advocates in the European Parliament entirely ignored tax incidence effects. Similarly, a recent discussion paper prepared by the IMF (2019) merely devotes one short, vague paragraph on incidence effects resulting from special taxes on certain digital services providers:

The efficiency effects of digital services taxes are not clear cut. The digital service tax looks like a simple turnover tax, likely to be passed on to some degree in the price of the taxed service. If the service, such as advertising, is itself used as business input then this becomes a potential source of production inefficiency. (IMF, 2019, p. 17)

It should be noted that the estimation of the tax incidence is a difficult undertaking. A large body of the tax incidence literature demonstrates that the size and distribution of the economic incidence will vary according to many impact factors, such as the precise type of tax, country-specific trade characteristics, labour market institutions and product market structures, e.g. the degree of competition or market concentration rates. As outlined by Clausing (2013), for example, taxes on corporate income can depress wages, but the complexity of real-world economies makes it difficult to observe the underlying relationships. In addition, Dyreng et al. (2019) state that a company’s ability to pass the economic burden of taxation to workers or consumers depends on its market position and competitive environment.

It is generally difficult to quantify second and third-round effects, e.g. the tax incidence imposed on suppliers if a company passes on the tax cost upstream, with implications on these suppliers’ customers, workers and owners. Generally, suppliers, which are often less mobile than their customers, can only escape lower prices if they find customers that are willing to pay more for the products and services they offer. Customers, which are usually relatively immobile, would have to go for alternative goods and services to avoid paying more. At the same time, workers are usually the least mobile factor, making them the most vulnerable group with respect to the financial burden of taxes on corporate income. Figure 3 outlines potential transmission channels underlying the incidence of taxes on corporate income.

Figure 3: Tax incidence effects and the impact of taxes on corporate income/revenues on workers, consumers, entrepreneurs and investors

Much of the focus of the empirical literature concerns the allocation of the corporate tax burden between owners of capital, workers and consumers. Various studies take account of the openness and size of the economy, capital/labour and product substitution elasticities inside a country or across countries, and specific factors related to a certain sector or if there are alternative products available (see, e.g., Clausing, 2012; Vasquez-Ruiz, 2011).

Most of the literature on the economic incidence of corporate income taxes focuses on the dimension of the burden that is borne by workers (Fuest et al., 2015). Academic literature outlines to a number of mechanisms through which a corporate tax effectively reduces wages. It is highlighted that taxes on corporate income reduce the economic surplus (rent) that is split between firms and workers. Simply put, as corporate taxes represent just another cost for businesses, taxes on corporate income reduce firms’ disposable income. As a result, there is less revenue left from which increases in employees’ wages could be funded. This does not imply that all wages would immediately rise after the elimination of taxes on corporate income, but, importantly, companies would generally have more means available to allow pay raises over time.

Another often-cited mechanism is the negative impact of taxes on corporate income on investment. Corporate taxes can decrease investment, which implies that the gains at firm level (and economy-wide productivity) are lower. Accordingly, lower investment tends to reduce the marginal productivity gain needed for wage increases. Again, it should be noted that the size and distribution of the incidence that is borne by workers will vary according to many impact factors, most of which are company-specific, but also the degree of competition or market concentration rates. Also, it is generally difficult to quantify second and third-round effects, e.g. multiplier effects resulting from higher levels of aggregate demand in response to increases in wages.

Firm-level studies are generally scarce, but studies that focus on aggregates, e.g. regional or national aggregates of corporations and wages, find that workers generally bear the largest share of the burden, which is estimated to amount to 50 to 70 per cent of the revenues raised from taxes on corporate income. Some studies find substantially higher tax incidence effects (for overshooting effects see literature provided in Table 2 in Baert et al., 2019, p 22).

Fuest (2015) outlines that most empirical studies focus the economic burden on workers, whereby the results also suggest that workers’ wages decline by roughly 50 per cent of the additional corporate tax revenue raised. At the same time, it is highlighted that the incidence on workers can only be observed within a period of one to four years after the tax change. Arulampalam et al. (2010), for example, identify a direct shifting effect resulting from taxes on corporate income. They find that an exogenous rise of USD 1 in tax would reduce the wage bill by 49 cents. Some studies come to the conclusion that the economic burden on workers is even more pronounced. Felix (2017), for instance, finds that the decline in wages in response to higher taxes is equal to more than four times the revenue raised by the corporate tax. A comprehensive overview of related tax incidence literature is provided in Table 2 in the Appendix.

A recent study conducted by Fuest et al. (2018) merits special attention because of its sensitive political implications. The authors address the question of whether higher corporate income taxes reduce wages in Germany. They study the causal relationship between workers’ wages and corporate tax changes for firms in 3,522 German municipalities over a 20-year horizon, resulting in 6,800 relevant tax changes. Fuest et al. find that workers bear about half of the total economic burden resulting from a tax change, whereby low-skilled, young and female employees bear a larger share of the tax burden. In addition, the authors conducted a number of additional analyses and robustness tests. Their major findings can be summarised as follows:

- German workers bear approximately 51 per cent of the corporate tax burden: Taxes on corporate income have a negative impact on wages, whereby the authors ‘hardly observe any decline in nominal wages’, but find ‘slower wage growth in affected firms over time, leading to lower [wage] levels in the future’. In other words, taxes on corporate income contributed to wage stagnation in Germany.

- Industry characteristics and trade intensities matter: Larger and significant effects are found for manufacturing and construction sector firms. The authors argue that ‘[o]ne explanation for the difference to trade and service sector firms could be that the latter are able to shift part of the burden to their customers as their products and services are on average less tradable than manufacturing goods’.

- Labour union-determined wages matter: The authors find larger negative wage effects for firms under collective bargaining agreements.

- Company size matters: The authors find that most of the incidence on wages results from incidence effects driven by small and medium-sized enterprises (SMEs), which in 2017 accounted for more than 95 per cent of firms in Germany. The results suggest that ‘workers in these companies are more affected by local corporate tax changes than employees of very large firms’. They argue that large firms, which often have a presence in more than one jurisdiction, can exploit more tax avoidance opportunities than smaller companies. They show, for example, ‘significant wage effects only for single-plant firms, while establishments in multi-plant firms show no wage response’.

- Workers’ skills and worker mobility matter: The authors find similar wage effects for medium and low-skilled workers, but no wage effects for high-skilled individuals, implying that high-skilled workers are better equipped to ‘escape’ the tax incidence from taxes on corporate income. It is argued that, in Germany, high-skilled workers are usually more mobile than low-skilled individuals.

- Blue-collar, young and female workers suffer most from taxes on corporate income in Germany: The authors find a significantly higher effect of the corporate tax incidence on the wages of young workers, female workers and blue-collar workers.

- Taxes on corporate income reduce the progressivity of the overall tax system: The authors highlight that, overall, the findings indicate that taxes on corporate income reduce the progressivity of the overall tax system. Accordingly, and different to the notions of most policymakers and tax justice activists, corporate tax avoidance can increase the progressivity of the overall tax system.

Studies about the incidence on capital owners (shareholders) are mixed. Some incidence is borne by shareholders, depending on how much alternative choice individual (or groups of) shareholders face regarding their investments (including investment within the company) and how mobile they are. While it is difficult to quantify the burden borne by shareholders and investors respectively, a general rule applies: the more mobile the shareholders are, the lower the burden borne by them will be, and the greater it will be on those that are less mobile. Owners and shareholders, whose capital is fairly mobile internationally, are generally well equipped to divest in high-tax jurisdictions to escape the tax and move capital to low-tax jurisdictions, which offer better risk-return profiles. As a result, the tax incidence is usually sensitive to the degree of openness of the economy.

Another general rule: The smaller the share of the corporate tax burden that is borne by workers and consumers, the more it is borne by shareholders (capital owners), and vice versa. However, as capital owners (shareholders and investors) are relatively mobile between sectors and internationally open economies, the growth of regional investment will show a relative decline after an increase in taxes as investors search for higher after-tax returns elsewhere, which implies that the tax burden is borne more by immobile factors, i.e. workers and consumers.

Capital ownership also matters. Some companies are owned by other companies, some are owned by pension or health insurance funds, a financial services firm or a public-sector institution, which are all characterised by different investment policies, differences in financial engagement and different degrees of long-term commitment. It is close to impossible to take into consideration all of these factors, which impact on the tax incidence borne by shareholders. At the same time, the empirical literature strongly suggests that the greatest part of the tax burden is borne by workers and not carried by the business owners and shareholders respectively.

The incidence of special taxes on digital services (DSTs)

Economic theory, as well as empirical evidence on consumption taxes, demonstrates that sales taxes (including taxes on value-added) are passed on to consumers. Policymakers generally accept this notion for direct taxes on citizens’ consumption expenditures. However, in the case of tax revenues from digital services, this notion has so far been ignored by those advocating for them for the EU as a whole and in some EU Member States. As discussed above, neither the European Commission nor Member States’ finance ministries provided impact assessments about the distortionary economic implications of DSTs.

A vast amount of empirical evidence suggests that companies pass on sales taxes to a significant extent to consumers through higher prices for goods and services (see, e.g., Cawley and Frisvold, 2016; Benedek et al., 2015; Smart and Bird, 2009; Carare and Danninger, 2008; Carbonnier, 2007). Numerous studies even report significant over-shifting effects for entirely new taxes or tax increases, i.e. changes in taxes drive price increases that are larger than the original tax change (see, e.g., Bergmann and Hansen, 2010; Besley and Rosen, 1999). The tax-induced price increase is often found to be higher the smaller a market and the lower competition in this market (see, e.g., Etilé et al., 2018; Andrade et al., 2015). As some companies targeted by European policymakers are leading players in the markets for online advertising and online intermediation services – and leaders in the innovation cycle – it is very likely that the DST will to a substantial extent be passed through to consumers, i.e. the users of digital services, with second and third-round incidence effects on the workers, consumers and owners of businesses users.

The precise size and distribution of these effects is debatable, but it is obvious that the burden of a tax on revenues from digital services will, to varying extents, be passed on to the consumers of these services. Indeed, on 1 August 2019 Amazon notified sellers of the change in its pricing policies for the French market, which takes effect 1 October: ‘Following the creation of a 3 per cent digital services tax in France, we would like to inform you that we will have to adjust our referral fee rates on Amazon.fr to reflect this additional cost,’ the company told sellers (Johnston 2019). Other companies affected by the tax are likely to follow suit.

For business users, e.g. SMEs that rely on online advertisement services to reach clients, the economic magnitude of the pass-through effect would be much higher for low or negative margin operations. A company with a 2 per cent profit margin will simply have no choice but to pass on the tax burden to downstream consumers in order to commercially survive. Not passing the tax on would wipe out business profitability and result in lower levels of market competition and upward pressure on the prices charged by other companies to downstream consumers.

Tax incidence effects are outlined in recent studies on the impact and incidence of those DSTs that have been taken into consideration by the European Commission and some EU Member States. Despite the lack of a quantitative analysis, the Congressional Research Services, for example, argues that the DSTs

are likely to have the economic effect of an excise tax on intermediate services. The economic incidence of a DST is likely to be borne by purchasers of taxable services (e.g., companies paying digital economy firms for advertising, marketplace listings, or user data) and possibly consumers downstream from those transactions. (CRS 2019, p. 2).

The authors also state that ‘DSTs are expected to be more regressive forms of raising revenue, as they affect a broad range of consumer goods and services.’

For the French government’s DST proposal, Deloitte (2019) expects affected companies to pass on the increased tax burden, which will result in higher prices for consumer goods in France, and a reduced profit for French businesses using digital platforms. They estimate that the total additional tax burden will be roughly EUR 570 million in 2019, which amounts to 150 per cent of the tax revenue raised (i.e. 50 per cent more than the tax revenue raised). Their estimations suggest that about 55 per cent of the total tax burden will be borne by consumers and 40 per cent by businesses that use digital platforms.

Similarly, with respect to the direct economic impact of the EU’s proposed DST, Copenhagen Economics (2018a) finds that the users of digital services will be hit by the DST through cascading effects on EU SMEs, consumers and jobs. Due to these effects, the authors highlight that the DST will generally harm EU consumer welfare. In a separate assessment of the EU’s DST on German businesses, Copenhagen Economics (2018b) highlights that the DST will, to a large extent, be passed on to German users. The authors also highlight that

[w]hile the global MNEs are collecting the tax and handing it over to EU tax authorities, they will likely pass on the tax burden to businesses and customers using online intermediaries or online platforms. At least in the long run we would expect that the introduction of the DST will be mirrored in an equivalent price increase. This implies that not global MNEs but German businesses, of which many are SMEs depending on the DST-liable services, and consumers using the services are bearing the tax burden.’ (p. 4)

For the Spanish government’s DST proposal for online platforms, PWC (2019) also outlines that the majority of the DST cost will be borne by SMEs using digital platforms. The authors highlight that consumers will experience a reduction in welfare due to a rise in the cost of the products as a result of the tax and a reduction in obtaining income from unused resources.

4. Quantifying the corporate income tax burden that is borne by workers

As outlined in Section 3, a vast body of empirical economic literature demonstrates that the effective financial burden of taxes on corporate income is, to a large extent, borne by workers. Accordingly, responsible policymaking requires that the incidence of corporate taxes is accounted for by the OECD, the EU and tax-sovereign governments with respect to reforms and the international reallocation tax revenues. Accountable policymaking requires policymakers to recognise that workers’ real incomes are directly and/or indirectly depressed by corporate taxes.

To facilitate a more informed policy debate internationally about the future shape of tax systems, this section provides some back-of-the-envelope estimates for the corporate income tax incidence that is borne by workers under the current system, and the share of the corporate income tax incidence borne by workers that would accrue to foreign governments if parts of the corporate tax base get reallocated to jurisdictions where users and/or customers are based.

It should be noted that the aim of this assessment is not to calculate net changes in government revenues, which may would result from changes in the international reallocation of corporate income tax base. Generally, one could use a country’s trade balance as a proxy to determine whether its government would have a net gain in corporate income tax revenue from a move to destination-based corporate taxation. However, this would probably not reflect the reality after an OECD reform. Given governments’ varying preferences, a consensus may at best result in a much more intransparent policy mix including, for example, partial reallocation of corporate income, the consideration of intangibles and some tribute to the principle of taxation according to where value-added takes place. In addition, some companies, including ‘easy-to-steer’ state-owned enterprises, may work towards zero profits, e.g. by using different legal mechanisms to allocate surpluses from exports to their owners or subsidiaries owned by the same (private or public) shareholders, while export revenues remain unchanged. The precise impacts of the OECD’s reforms towards destination-based taxation are therefore difficult to project. This is true for both revenue gains and shortfalls and even more so for the future distribution of the tax incidence among workers, consumers and entrepreneurs.

Acknowledging that workers bear by far most of the corporate income tax burden, the aim of this assessment is to demonstrate that individual workers in some countries would effectively have to pay taxes to governments that do not represent them. Due to the complexity of corporate tax code and tax incidence-induced double taxation effects, it is impossible to determine the total tax burden that is borne by individual workers, e.g. those of exporting companies and, for example, workers in other companies that associated exporting companies. Therefore, even if some governments enjoy a net increase in government revenues from new corporate tax base allocation rules, the additional tax revenues would not be enjoyed by those workers that indirectly pay taxes to foreign governments and, accordingly, suffer from lower wages or lower wage growth. These mechanisms, which are critical for any objective assessment of the distributional impact of taxes on of labour income, need to be addressed by policymakers. Thereby, policymakers should refrain from country- or government-level analysis and account for real income effects on a worker-by worker basis. Moreover, the funds effectively provided by individual workers of exporting companies add to the general government budget in the export-destination countries. In some cases, e.g. when companies export to China or India, these funds add to the general government budget, from which state-owned enterprises (SOEs) are funded. As a result, some workers in exporting countries may even provide funds to SOEs with which they compete. These mechanisms demonstrate that the distributional effects on labour income would be even more difficult to determine, if a reform towards destination-based corporate taxation would materialise. A corporate tax reform along the lines suggested by the OECD would not render corporate taxation fairer.

The author acknowledges that the following approximations do not fully reflect the tax incidence that is borne by workers in a specific country. The size of the tax incidence critically depends on a number of determinants, which vary across individual firms, sectors and countries. The degree of competition as well as labour market institutions, for example, frequently impact on firm-level decisions to pass on the tax burden to workers (and others along the value chain).

The author also acknowledges that there are different notions regarding the design of more transparent and at the same time less distortive forms of direct taxation, which can be taken into consideration by governments for the funding of public services. The following estimations are nevertheless an attempt to quantify the annual financial losses for workers, in terms of lower annual (labour) income, which accrue from non-transparent, distortive and discriminatory taxes on corporate income. The estimations also allow policymakers to better understand the ‘subsidisation effect’, which would result from a reallocation of corporate income tax revenues. A reallocation of corporate income tax revenues would result in a subsidy that workers would have to pay by law to foreign recipient governments. This subsidy would accrue if employers (domestic companies) were legally required to pay taxes to those jurisdictions in which their users and/or customers are based, i.e. foreign governments that do not democratically represent these workers. In corporate tax lingo, this would be an infringement of the ‘democratic arm’s-length principle’. The tax amount charged by a foreign government would be detached from any voting right on the side of foreign companies and foreign companies’ workers who are known to bear the largest part of the tax.

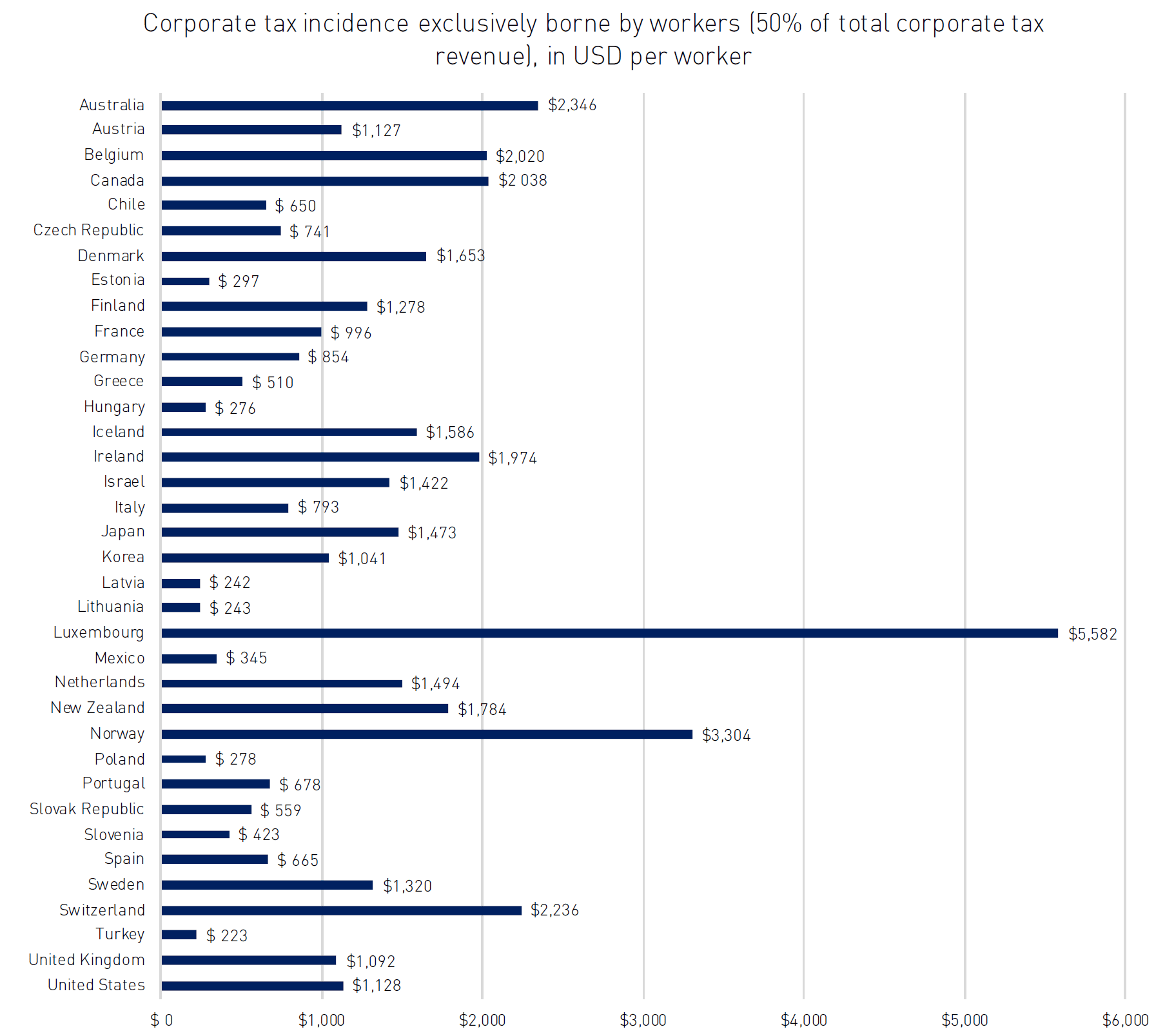

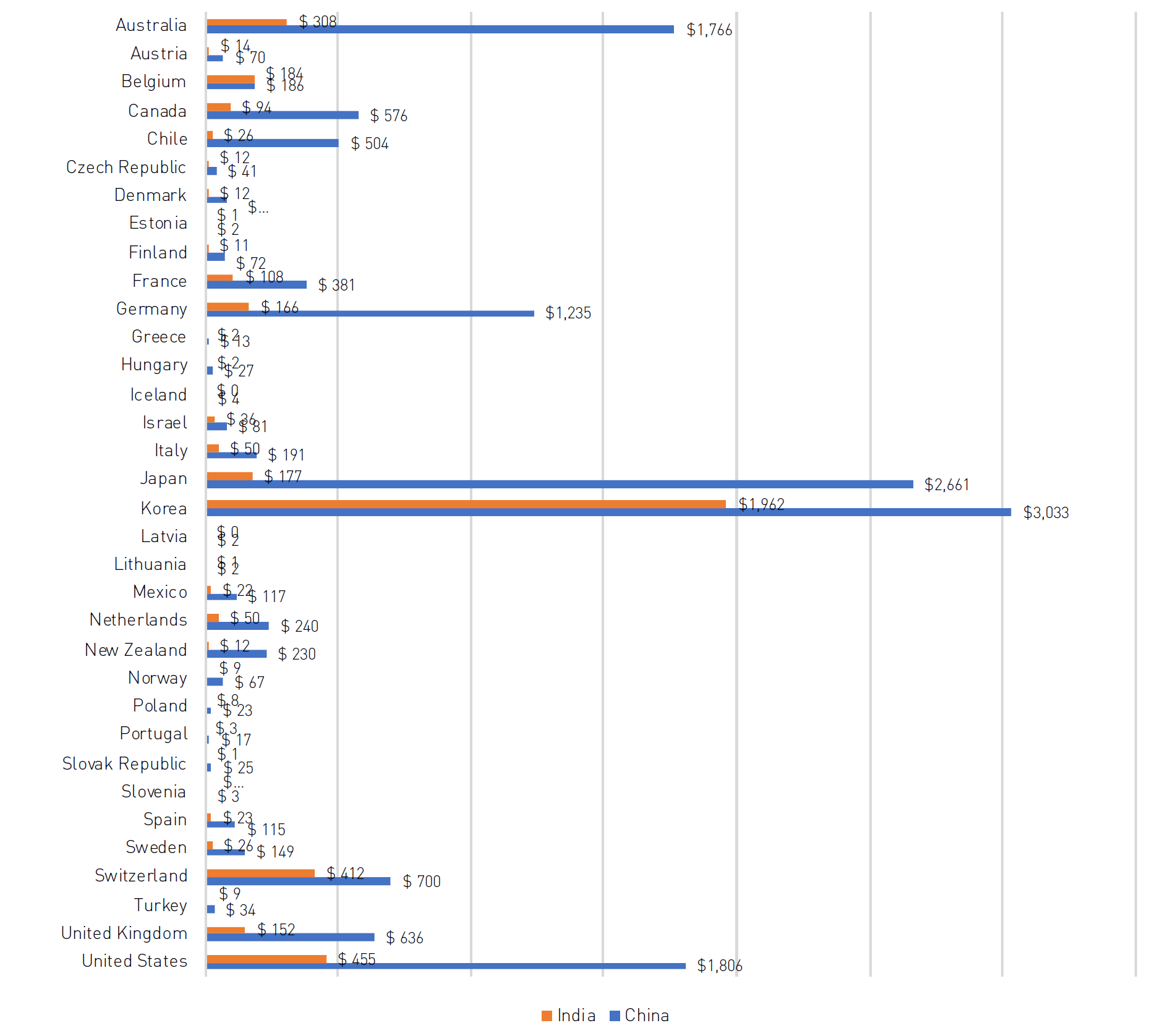

Focusing on OECD countries, the first part of the analysis provides estimates for the overall tax incidence that is borne by workers under the current tax regimes. It outlines the tax incidence that accrues to workers in OECD countries based on the revenues collected from taxes on corporate income (Figure 4). The second part of the analysis provides estimates for the export-related corporate tax incidence that is borne annually by workers in OECD countries. The latter measure is applied to derive workers’ export-related annual income losses that result from the imposition of corporate income taxes. Under a new legal regime for tax revenue reallocation, as considered by the OECD, this part of the corporate tax incidence would be equivalent to an annual subsidy paid by domestic workers to foreign governments. For illustrative purposes, estimates for the annual subsidisation effect are provided for China and India, i.e. the annual subsidy workers in OECD countries would have to pay to the governments of China and India (Figures 5 and 6).

Methodological considerations

In a first step, annual revenues from taxes on corporate profits are taken from the OECD’s tax database. Based on the insights from the empirical literature (e.g. Fuest et al., 2018; Fuest, 2015 and Arulampalam et al., 2010), it is assumed that the overall tax burden that is borne by domestic workers equals 50 per cent of the total nominal corporate income tax burden, i.e. half the total tax revenues collected from corporate income. This assumption is in line with the US Tax Foundation’s Taxes and Growth General Equilibrium Model, which assumes that the corporate income tax is (only) borne by both capital and labour and split evenly, i.e. 50/50 (Tax Foundation, 2018). The 50 per cent split is at the same time a rather conservative estimate. By comparison, Milanez (2017) and Baert et al. (2019) present several empirical studies on the corporate tax incidence that find the financial burden on workers ranging from 30 per cent to 400 per cent. The overshooting reflected by numbers larger than 100 per cent demonstrates that the corporate income tax not only depresses the wages of workers; it also has a dampening effect on the economy as a whole, depressing economic activity due to reduced productivity, lower investment, less innovation and less purchasing power.

In a second step, World Bank data on labour force statistics are used to calculate the average corporate income tax burden that accrues to workers. As regards the labour force, no distinction is made for private and public sector workers. It is also assumed that taxes on the profits that are related to exports are fully reallocated to countries where users and consumers are based.

In a third step, the overall corporate tax incidence that is borne by workers is allocated to the countries’ overall exports, which results in the total export-related tax incidence that accrues to domestic workers. In other words, it is implicitly assumed that the share of profits from exports equals the share of exports in total output (GDP). It should be noted that this is a rather rough approximation, as the share of revenues from exports does not necessarily equal the share of profits generated from exports. Due to the lack of more appropriate data, this simplification is considered an appropriate approximation to derive export-related corporate income tax revenues on a country-by-country basis. No distinction has been made for large companies or allocation policies that only target some residual profits (which, after all, is a dubious concept).

In a final step, bilateral export shares are used to calculate that part of the export-related tax incidence on workers that would be shifted to China and India under a new regime of tax revenue reallocation. It is assumed that the corporate tax base would be reallocated according to where the users or consumers of goods and services exports are located, i.e. users and consumers based in China and India.

Results

As shown by Figure 4, the average corporate income tax incidence per worker is largest for countries that collect a relatively high share of taxes from corporate income. According to recent tax data, for example, taxes on corporate profits collected by the government of Luxembourg amounted to 13.6 per cent of total tax revenues in 2017. Based on the overall corporate income tax revenue, the average corporate income tax incidence per worker in Luxembourg amounts to an equivalent of USD 5,582 per year.

The average annual tax incidence borne by workers is also comparatively high for Norway, Belgium and Ireland, amounting to USD 3,304, USD 2,020 and USD 1,974 per worker respectively. Countries whose governments are less dependent on taxes on corporate income show relatively low estimates for the tax incidence per worker. The average tax incidence borne by French workers amounts to USD 996 per year, while the average annual tax incidence of German workers amounts to USD 854. It should be noted that in 2017 the French government collected only 5.1 per cent of its total taxes from taxes on corporate income. Similarly, Germany’s government collected a mere 5.4 per cent in taxes on corporate income relative to the total 2017 tax revenues.

Figure 4: Average corporate income tax incidence exclusively borne by domestic workers, by OECD country, in USD per worker per annum

Figures 5 and 6 below provide numbers for the aggregate tax incidence as well as the average tax incidence borne by domestic workers that would accrue to the governments of China and India. As outlined above, these estimates are equivalent to an indirect subsidy paid by domestic workers in OECD countries, if domestic export businesses would have to pay taxes on their export-related profits (i.e. profits generated from exports to China and India) to the governments of China and India respectively. Generally, the estimates suggest that the overall implied tax subsidy paid by European workers to foreign governments would amount to more than 91 billion USD annually.

Take China as an example. As depicted by Figure 5, the tax incidence of taxes on profits from exports to China is generally highest for countries that show relatively high volumes of exports to China, e.g. Japan, South Korea, the USA and Germany. For these countries, the total annual corporate tax incidence borne by workers, which would be shifted to China under a new profit reallocation rule, amounts to up to USD 2.7bn, USD 3bn, USD 1.8bn and USD 1.2bn respectively. It is assumed that taxes on the profits from export activities are fully reallocated to those countries where users and consumers are based, i.e. China in this case.

Figure 5: Total export-related tax incidence accruing to domestic workers, with regard to exports to China and India, in million USD per annum

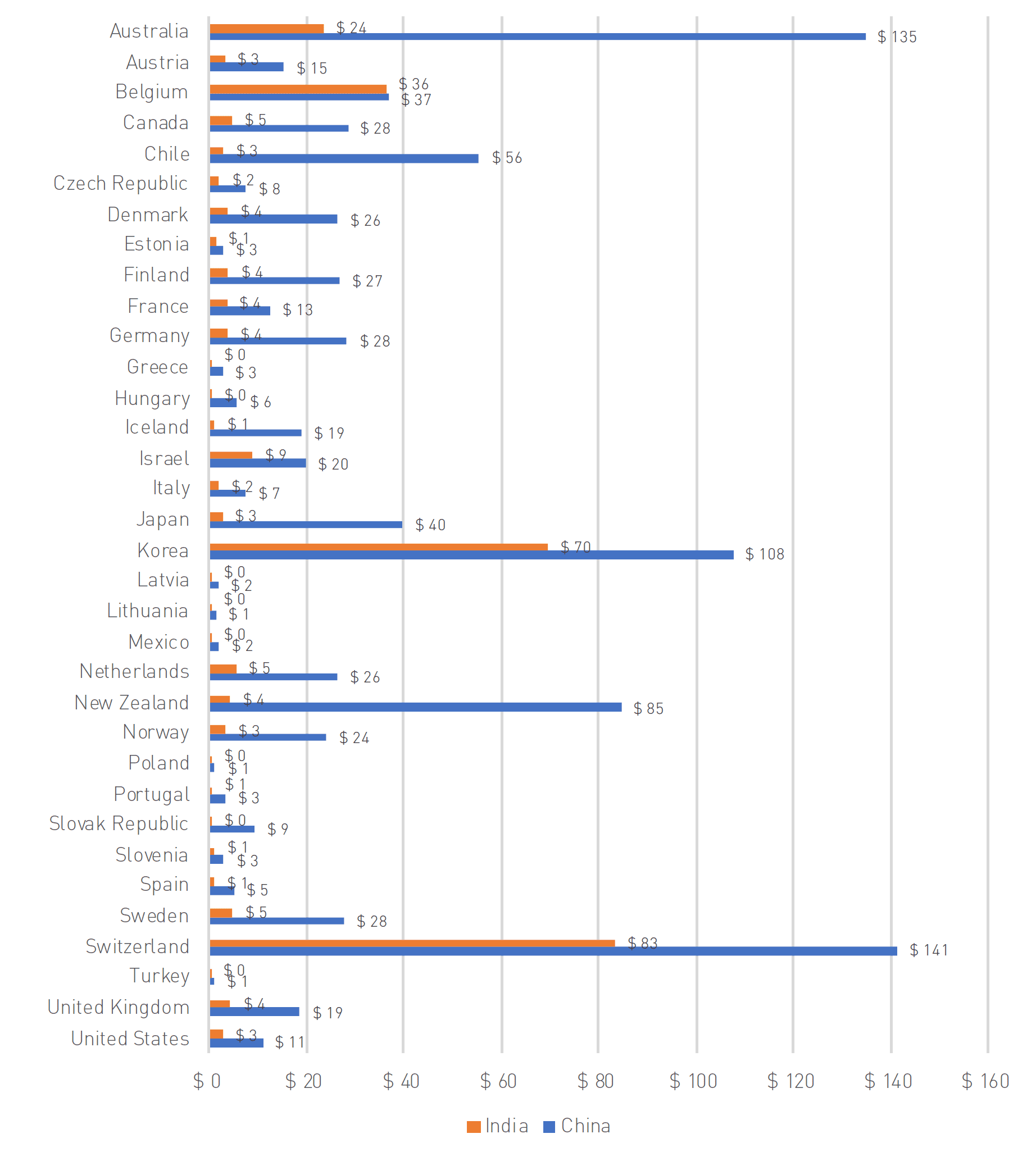

Figure 6: Tax export-related incidence borne by domestic workers, with regard to exports to China and India, in USD per worker per annum

Expressed in numbers per worker per year (Figure 6), the average export-related corporate tax incidence per domestic worker that is attributable to exports to China is highest for workers in Switzerland (USD 141 per year), New Zealand (USD 85 per year) and South Korea (USD 108 per year). For EU countries, the average annual export-related corporate tax incidence per domestic worker is highest for Belgium (USD 37 per year), Germany (USD 28 per year), Finland (USD 27 per year) and Denmark (USD 26 per year).

It should be noted that there are many factors than can either inflate or deflate the tax incidence that is borne by a country’s entire labour force and individual workers respectively. Calculating the tax incidence for private-sector workers only, for example, would significantly increase the average corporate income tax burden per worker. Taking into consideration those private sector jobs that are directly depending on exports would result in even higher numbers on a per capita basis. Medium- to long-term effects would also impact on public sector wages. Labour mobility between sectors would eliminate wage differentials, i.e. the corporate income tax effect would affect public sector workers as well.

Policymakers, academics and tax activists involved in the corporate tax reform process should call for or conduct impact assessments that account for tax incidence effects, including double-taxation effects and the distributional consequences (e.g. lower levels of progressivity in the overall tax system as a result of corporate income taxes) that arise from the tax incidence. With regard to the OECD’s policy ideas, these effects need to be analysed for every exporting countries’ tax base.

Since many governments pursue economic policies (models) that involve high degrees of state interventionism and high levels of state-owned enterprise engagement, e.g. China and India, a reallocation of tax base to countries where users or customers are based would imply that workers in exporting market economies may eventually subsidise SOEs in the recipient countries. This raises a number of additional concerns similar to those currently occupying the debate about international trade and investment policymaking. The new subsidy scheme, as envisaged by the OECD, brings to the fore a number of critical concerns that have for a very long time occupied international economic diplomacy. These concerns go beyond the mere role of government intervention in the economy and international trade, e.g. subsidies and tax credits. They are about democratic legitimacy and representation, as well as foreign governments’ respect for human rights, labour rights and freedom of speech.

5. Conclusions for government accountability in tax policymaking

The recent tax reform proposals from the EU and the OECD emerged at a time when policymakers across the globe were praising the opportunities resulting from the digitalisation of the global economy. Policymakers generally recognise that tax-sovereign governments, including the 28 EU Member States, apply different and complex corporate tax laws, which cause high compliance costs for domestic and international businesses, particularly SMEs. Large corporations, as well as SMEs, therefore call for simpler and more harmonised corporate tax rules in the EU. Benchmarked against the status quo, more harmonisation would render corporate taxation in the EU more conducive to investment, innovation and structural economic renewal.

However, the vast empirical literature on the corporate tax incidence, as well as the estimates provided in this paper, demonstrate that the reform of corporate tax regimes and the reallocation of taxing rights is not a trivial undertaking. The current policy debate is still almost exclusively about complex and often unreasonable technical issues, such as nexus rules and vague rules for the identification of residual profits. Policymakers, technical and legal advisors but also tax activists have so far ignored the significant distributional impacts of corporate income taxes. Since tax incidence considerations did not attract strong media publicity either, the adverse impacts of corporate income taxes on households’ disposable incomes (less purchasing power, wage depression, wage stagnation) and tax progressivity are hardly known by citizens and many politicians.

Biases in media coverage and policymakers’ (deliberate or convenient) ignorance of incidence effects distort public opinion and thereby reinforce problems of fiscal illusion and tax obfuscation for the general public.[11] As a result of the tax incidence, the opaqueness and heterogeneity of corporate income tax law and multiple double taxation effects, it is impossible to objectively measure the real tax burden that is carried by individual citizens. In other words, it is impossible to maintain corporate taxes if the overarching political objective is to achieve more transparency and more (perceived) fairness in taxation.

Tax incidence and the OECD’s corporate tax subsidy scheme

While special taxes on digital services would be borne by those using these services, particularly small and micro businesses (with knock-on incidence effects on workers, consumers, entrepreneurs and investors), the OECD-proposed reallocation of corporate tax bases raises more fundamental questions.

The global reallocation of tax bases, as envisaged by the OECD, brings to the fore a number of critical concerns that have for a very long time occupied international economic diplomacy. These concerns go beyond the mere role of government intervention in the economy and international trade, e.g. subsidies and tax credits. They are about democratic legitimacy and representation (no taxation without representation), as well as foreign governments’ respect for democracy, limited government, human rights and the freedom of speech.

First, a reallocation of tax revenues to countries where consumers are based would imply that workers of companies in market economies would fund foreign governments that do not represent them. Obviously, China and India stand out for two reasons: the sheer size of their populations, and the substantial and, by Western (OECD) standards, disproportionate degree of government-interventionism in the economy. The OECD has so far not assessed the economic, social and human rights impacts of the proposed changes.

Second, China and India are subject to high degrees of state interventionism. As a result, workers of companies in market economies would indirectly subsidise SOEs in these countries (and other recipient countries). In other words, corporate taxation according to where users/customers are based would result in indirect subsidies paid by market economies to interventionist countries’ state-owned enterprises with whom they may even compete. As outlined above, the implied tax subsidy for the EU paid by European workers to the government of China amounts to more than USD 3.5 billion per year, with workers in Germany alone accounting for about USD 1.2 billion annually.

Despite numerous consultations, workshops and roundtables, OECD and EU policymakers have so far kept silent about the distributional consequences of their proposed corporate tax reforms. This is true for the OECD’s endeavours regarding the global reallocation of taxing rights, as well as the EU’s initiative to popularise special taxes on digital services. The OECD and national governments have, to date, failed to assess the amount of tax revenue that would be diverted from market economies to destinations that are known for human rights violations, substantial involvement of state-owned enterprises in the economy and other government-induced distortions of international competition.

Tax obfuscation and bureaucratic opposition to tax competition

Given the path dependency of national tax systems and the political economy barriers to reform, tax competition is the most promising way to achieve simpler and more transparent tax systems at the national level. Limitations on tax competition would impede the evolution of modern, i.e. simpler and more transparent, tax systems that stand a chance of being considered fair by more informed local populations. Collective tax planning, as currently envisaged by the EU, the OECD and parts of the international tax policy community, would not resolve any of the complexity problems inherent in corporate income tax law. Nor would it, on current trends, contribute to more economic efficiency and transparency and greater levels of perceived tax fairness among the general public.

Despite the well-recorded benefits of tax competition, bureaucratic opposition is likely to remain resilient among those who are currently involved in the OECD’s corporate tax reform initiatives. After all, tax obfuscation is still a common feature of fiscal policymaking by governments across the world, disguising the serious distributional impacts of taxes in general and corporate taxes in particular. As already outlined by Buchanan in 1960,

[a] final form of fiscal illusion involved on the levy of taxes comes about in the uncertainty concerning the actual incidence of the tax. Government will try not to levy taxes for which the incidence is known. The aim will rather be to induce as much uncertainty as possible thus keeping the individual in the dark concerning the actual amount of tax which he does pay in real terms. (Buchanan, 1960, p. 62)

Tackling fiscal obfuscation or, in other words, paving the way for a fundamental reform to achieve simplicity, transparency, accountability and fairness in taxation, requires strong, perhaps unprecedented, political leadership. Following the extensive analysis of tax competition by Teather (2005), some political opposition to tax competition will remain strong. It mainly arrives from groups that are generally opposed to ‘global free markets’ and ‘certain economists and academics who believe that tax competition leads to sub-optimal levels of government spending’. Yet, any corporate income tax reform should be considered an accountability initiative towards good governance regarding national and international tax collection and tax law enforcement. Those in favour of accountable governments, transparency and efficiency in taxation should thus embrace tax competition – and reject any collective initiative that contradicts simplicity, transparency, fairness and government accountability in taxation.